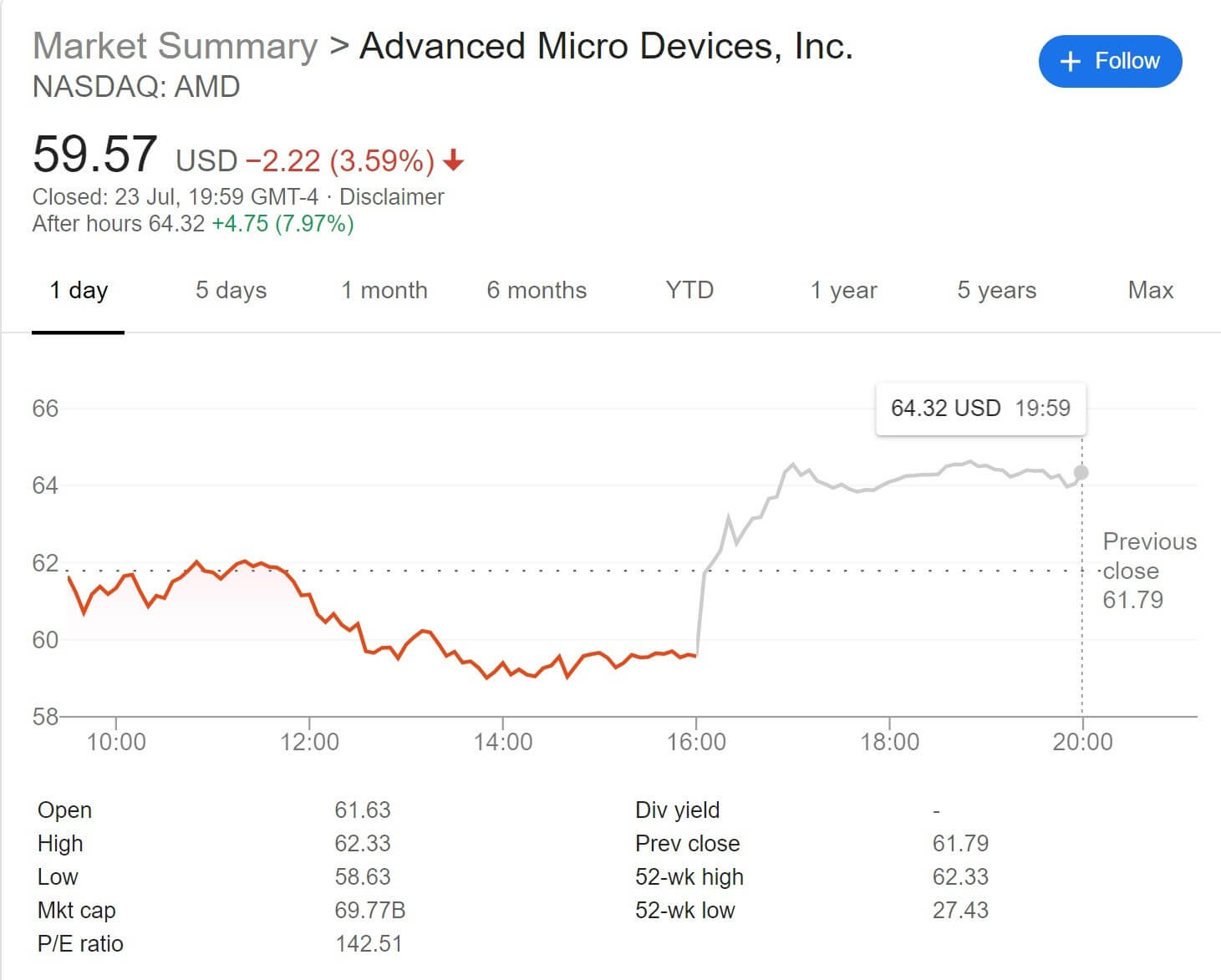

What just happened? While it's turning out to be a good year for AMD, the same can't be said for Intel. For the first time since 2006, team red's share price has climbed higher than Chipzilla's, and the gap has grown even wider in after-hours trading following Intel's admission that 7nm production will be delayed by at least six months.

In its second-quarter earnings report yesterday, Intel revealed that revenue is up 20 percent, but complications mean 7nm-based CPU production is backed up and 12 months behind schedule, meaning a delay of at least six months.

AMD, of course, has been on 7nm since the release of its Zen 2 architecture in July last year. With news that Intel will take even longer to catch up with its processor rival, the company's shares sank in after-hours trading, while AMD's soared. Lisa Su's firm already saw its share price briefly surpass Intel's hours before the earnings report---something that hasn't happened since 2006. Currently, Intel stands at $54, while AMD is at $64.32.

AMD is still far behind Intel when it comes to market cap, calculated by multiplying the share price by the total number of outstanding shares. The former is at just under $70 billion, while the latter is $255 billion. Nvidia, which for a short time was valued higher than Intel, is at $249 billion.

While the pandemic has brought economic doom and gloom for many, big tech firms have benefitted thanks to demand from datacenters, gamers, and online shoppers. With AMD confirming the arrival of consumer Zen 3 this year, and Nvidia's RTX 3000-series on the way (and it's possible acquisition of Arm), expect the companies' stock to rise even higher.