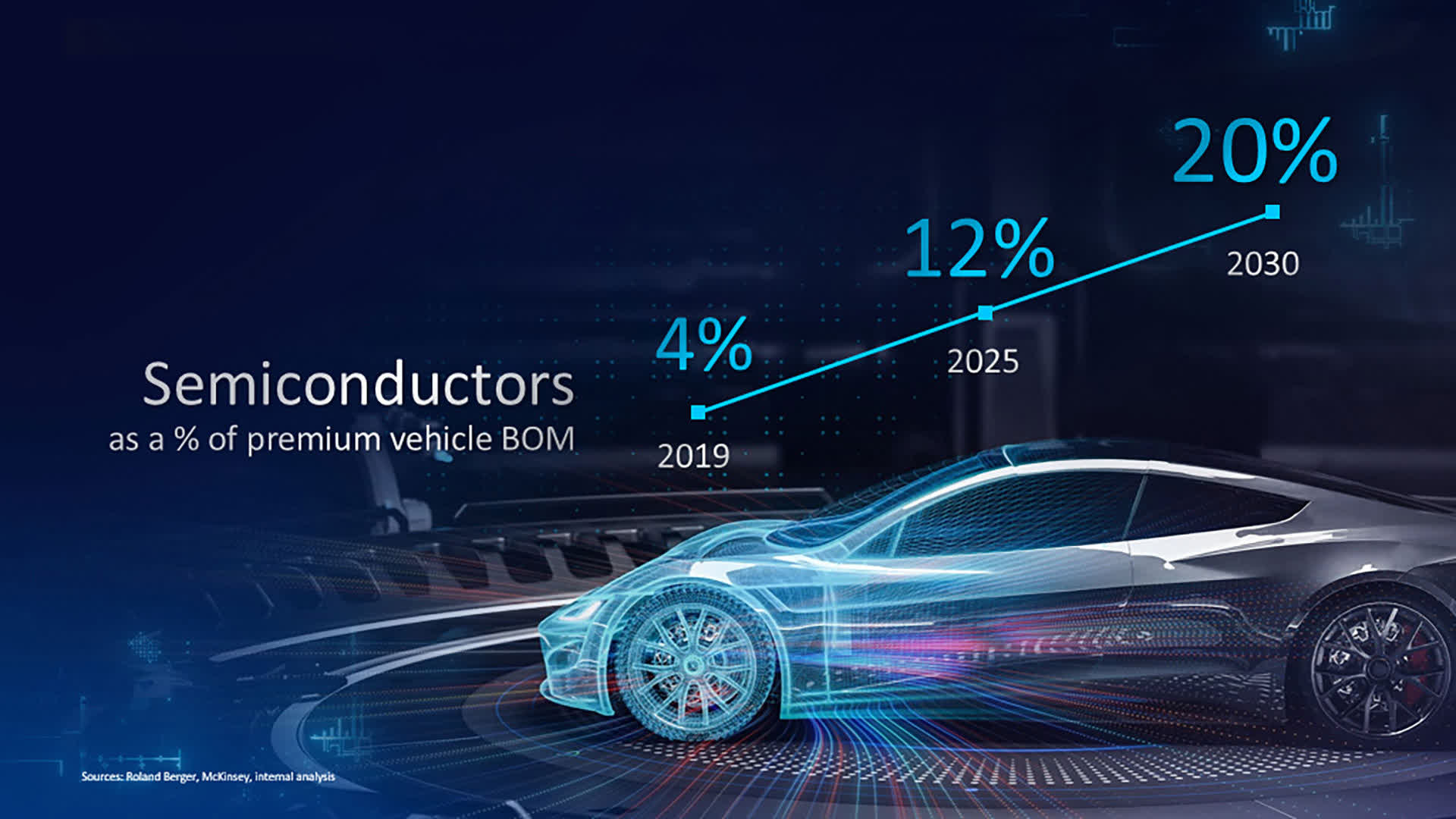

In brief: With the modernization of vehicles, the number of chips needed to manufacture them increased proportionally. By 2019, semiconductors only accounted for four percent of a premium vehicle's bill of materials (BOM), but this value is expected to grow in the coming years. By 2025, 12 percent of the BOM should be used on chips, growing to 20 percent by 2030.

The predictions presented at IAA Mobility by Pat Gelsinger, Intel's CEO, represent 5x growth over 11 years. Besides the increase of semiconductors to manufacture premium vehicles, Gelsinger also expects to see the total addressable market (TAM) hike to $115 billion by the end of this decade, representing over 11 percent of the entire silicon TAM by then.

According to Gelsinger, the reason for this is "the digitization of everything" alongside the other "four superpowers:" ubiquitous computing, pervasive connectivity, cloud-to-edge infrastructure, and AI. These four are paving their way into the automotive industry, as manufacturers offer driverless systems, driving assists, navigation systems, improved security features, and so on.

The increased need for semiconductors is prompting Intel to invest in new fabs and upgrade existing ones. In the US, we already know about Intel's plans of a $120 billion mega-fab and the $3.5 billion investment in the New Mexico fab. Across the pond, the company plans to build two fabs with a joint investment of €80 billion.

Intel is also discussing with its European partners the best way for them to use improved node processes. Vehicle chips are predominantly based on older nodes, but Intel expects to change this in the coming years. To do so, the company is committing capacity in its Ireland fab to the automotive industry, as well as launching the Intel Foundry Services Accelerator, a program designed to help automotive chip designers transition to advanced nodes.

"This new era of sustained demand for semiconductors needs bold, big thinking," said Gelsinger. "As CEO of Intel, I have the great privilege to be in a position to marshal the energies of 116,000 employees and a massive chip-design and manufacturing ecosystem, to meet the demand."

Gelsinger's expectations come amid what might be the worst time of the ongoing chip shortage, as chip lead times recently reached record highs of 26.5 weeks and foundries increased chip prices significantly. Even car manufacturers like Toyota had to cut production by 40 percent because of the ongoing situation.

We sincerely hope Gelsinger's expectations can be met and improve the dire condition in which the semiconductor industry is currently in.