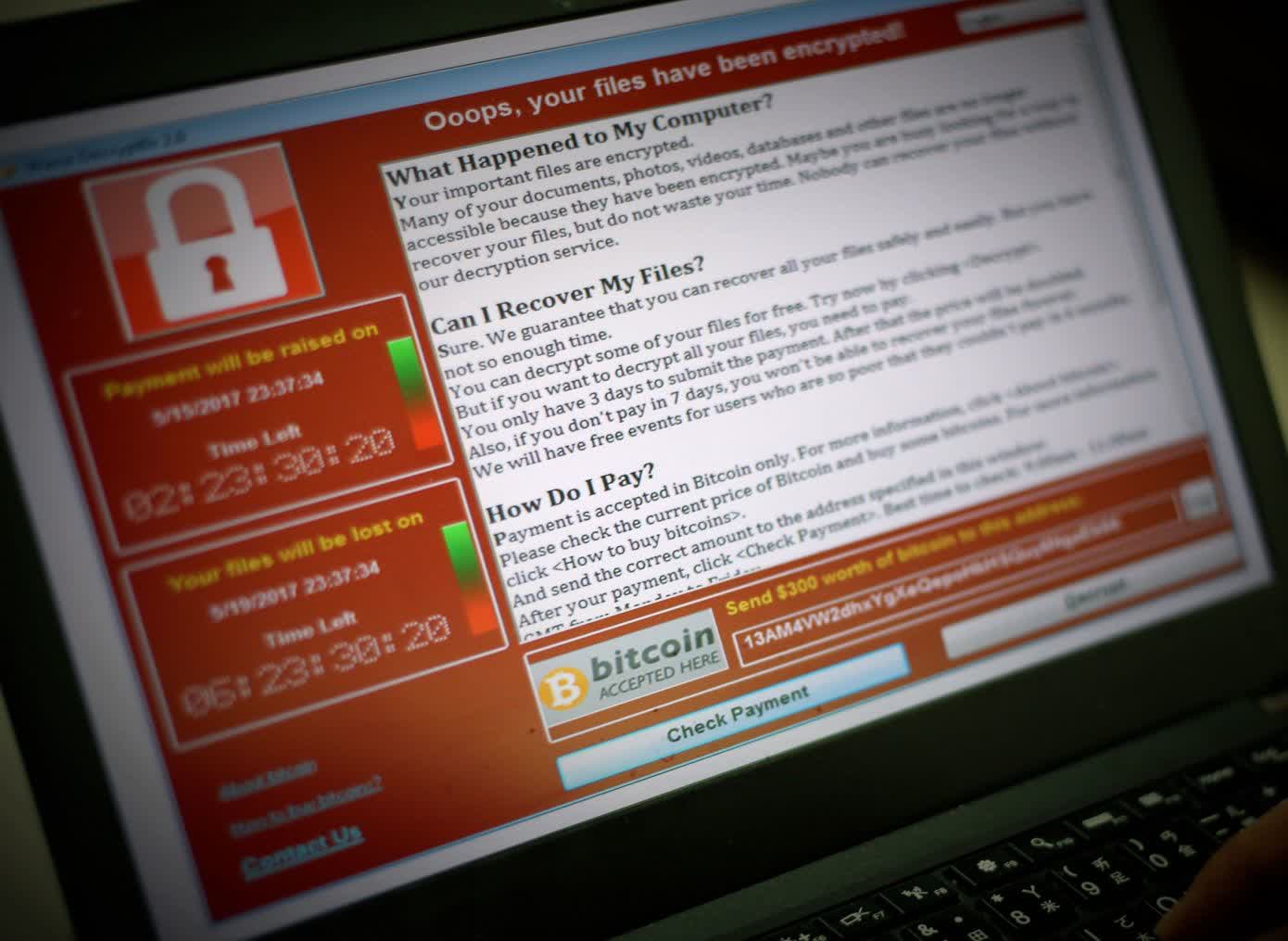

A hot potato: Cyberattacks have increased in frequency since the start of the pandemic, and they're reaching unprecedented levels. Ransomware accounts for almost half of all cyber insurance claims for the first half of the year, with some going into seven figures territory.

Last year, ransomware attacks jumped 41 percent and hit hundreds of thousands of organizations that were forced to pay dearly to get access to their important files. The number of attacks increased 25 percent during the first months of the pandemic, as ransomware makers didn't make good on their promise to refrain from targeting medical organizations.

It's currently estimated that a ransomware attack occurs every 11 seconds, with projected damages totalling $20 billion by the end of 2020.

The number of campaigns have increased sevenfold, and attackers are aiming at bigger organizations every month in the pursuit of higher payouts. Examples include Garmin, cruise line giant Carnival, Canon, and the University of Utah, which made the news last month for having footed a $457,000 ransomware bill.

A new report from Coalition, which is one of the largest cyber insurance providers in the US, reveals that the first six months of 2020 have been particularly hard for many organizations, as almost 41 percent of all claims paid out were related to file encrypting malware.

Coalition says it saw a "260 percent increase in the frequency of ransomware attacks amongst our policyholders, with the average ransom demand increasing 47 percent." The most prominent ransomware groups are Maze and DoppelPaymer, which are only two out of a growing list that have adopted aggressive tactics where they threaten organizations that failure to pay the ransom will result in their documents being leaked online.

Ransomware insurance claims ranged from $1,000 to over $2,000,000 per incident. The most affected industries by ransomware are manufacturing, education, and healthcare, but there is virtually no industry that hasn't been hit by at least a few campaigns. Besides ransomware incidents, there was a growth in the number of money transfer frauds and business email compromise, which were 35 percent and 67 percent higher than 2019 levels, respectively.

Interestingly, Coalition found that companies using Microsoft Office 365 were three times more likely to experience a business email compromise incident than companies using alternatives such as G Suite or WPS Office.