Adena Friedman laid out plan to bring more of Nasdaq’s innovations and the cloud to financial markets by partnering with AWS.

This year’s AWS re:Invent conference demonstrated the cycle of change extends from new leadership at AWS itself to the ways the financial system may evolve in the coming years.

Adam Selipsky led his first keynote at re:Invent as CEO of AWS since taking the role in May. This year’s conference was held in-person in Las Vegas with remote video streams. Selipsky said that since the launch of AWS some 15 years ago, the cloud has enabled a fundamental shift in the way businesses function. “There’s no industry that hasn’t been touched and no business that can’t be radically disrupted.”

Despite such a trend, he said adoption is still in its early days. Selipsky said analysts estimate between 5% to 15% of IT spending has moved to the cloud. That leaves a lot room for more workloads to move to the cloud in the years to come, he said.

Selipsky painted a rosy picture of the cloud’s potential, with 5G and IoT pushing the edge of the cloud to new places, as well as seamless integration of data, analytics, and machine learning. Such innovations seem poised to drive new transformations in the financial sector.

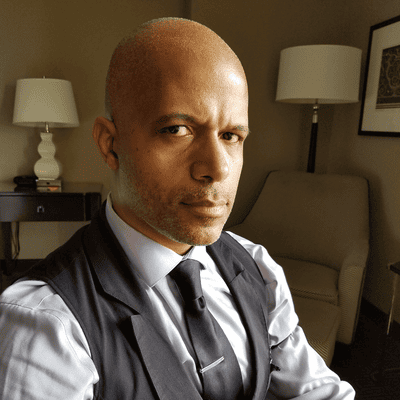

Nasdaq CEO Adena Friedman joined Selipsky onstage offering some perspective on how the stock exchange operator continues to take advantage of the cloud. She said Nasdaq plans to bring the cloud to financial markets in partnership with AWS, along with its other efforts to further expand its footprint beyond its markets. “[Nasdaq is] a technology company and a SaaS provider to the broader capital markets ecosystem,” Friedman said.

Technology from Nasdaq can be found in some 130 markets around the world, she said, with trading, clearing, settlement, and surveillance solutions. “We provide the technology that powers from Singapore to Brazil, from Japan to Switzerland,” Friedman said. Nasdaq has also put its financial markets expertise to develop new marketplaces that include crypto exchanges and sports betting platforms.

The scope of Nasdaq’s systems, which are responsible for transacting hundreds of billions of dollars each day, means there are essential technology attributes she said are needed to conduct such activity successfully in the cloud. “They are to be hyper-scalable, ultra-resilient, highly performing down to the nanosecond, and fair for all participants,” she said. Nasdaq’s order to trade processing occurs in 20 microseconds or less, Friedman said. “To put that into perspective, that’s 10,000 times faster than the blink of an eye.”

Nasdaq provides AWS-based SaaS solutions to the broader capital markets ecosystem. They also provide anti-financial crime technology to 2,000 banks and credit unions, she said. “The data-centric architecture of the cloud allows us to deploy very advanced algorithms to catch criminals across the whole financial system.”

Friedman said Nasdaq has been working on bringing its market services to the cloud and in 2022 will bring its first US options market to the AWS cloud. “We will follow with more of our markets as we work closely with our clients, regulators, and other constituents,” she said.

Other recent collaborative efforts between Nasdaq and AWS have included the development of ultralow latency edge compute systems designed for the capital markets, Friedman said. “Leveraging the hybrid cloud capabilities of AWS Outposts, we can now bring the edge directly into our primary data center in Carteret, New Jersey, creating the first-ever capital markets private local zone.”

In other words, Nasdaq will use AWS compute and other resources out of that data center. That will be part of creating a cloud center within the Nasdaq footprint and allow for the transition of its US markets to the cloud. The plan is to eventually expand this strategy to other geographies, including Nasdaq’s 130 market technology clients. “We’re already engaged with AWS to deploy cloud-based trading and clearing solutions for several marketplaces and clearing houses around the world,” Friedman said.

Related Content:

HPE and Transamerica Open Their Cloud Transformation Playbooks

About the Author(s)

You May Also Like