In brief: As if the GPU/CPU shortage wasn't enough of a headache for PC owners, it appears concerns that Chia mining would impact the storage industry were warranted. According to a new report, Adata has seen its solid-state drive orders increase 500% this month, with large-capacity SSDs experiencing exceptionally high demand.

The Chia blockchain uses a 'proof of space and time' model instead of 'proof of work' (Bitcoin) or 'proof of stake' (Etherium 2.0). People can mine or farm the crypto by allocating their unused disk space, along with a time factor tied in for increasing the blockchain's overall security.

Chia isn't tradeable until May 3, but there's already been a surge in demand for large capacity hard drives and SSDs in China. DigiTimes reports that orders for Adata's high-capacity SSDs have risen 400% to 500% in April compared to the previous month

Earlier this month, Jiahe Jinwei, China's fourth-largest memory manufacturer, said all its Gloway and Asgard-branded 1TB and 2TB NVMe SSDs were sold out.

We're hearing more reports that demand for drives is starting to expand outside of Asia. Given that component shortages are increasing the price of SSD controllers, Chia mining could exacerbate the problems of low drive availability and high prices.

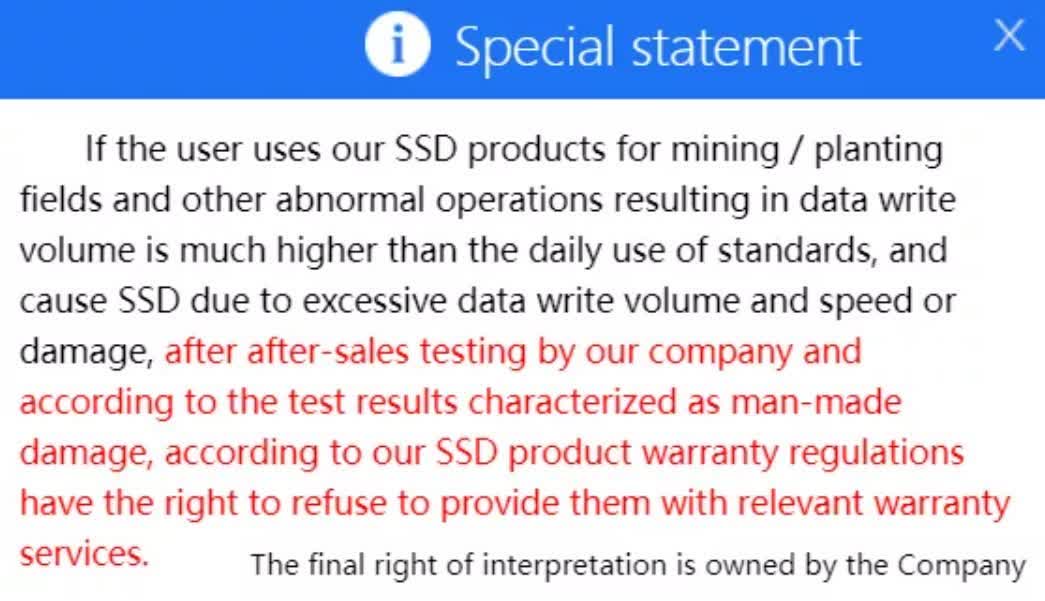

There is a glimmer of hope. Galax has placed a warning (via Tom's Hardware) on its Chinese website stating that using their SSDs to mine crypto or other operations where the data write volume is higher than standard will void the warranties. Hopefully, this might discourage people from buying vast quantities of drives.

There's always the chance that Chia or other storage-based cryptos won't be as popular or lucrative as, say, Bitcoin. However, with people panic buying in case it is the next big thing, Chia could become another reason why there's never been a worse time to build a PC.

Image credit: Sergei Elagin