Exploring Grab’s New Cryptocurrency Payment Feature

On March 19, 2024, Grab made waves in the digital payment realm by introducing a brand-new feature: cryptocurrency top-up capabilities within its digital wallet. This move marks a significant milestone in the region’s super-app landscape. As I have been tracking blockchain and crypto since 2016, I couldn’t resist delving into this innovation to assess its potential impact on the payments industry. Here’s a brief rundown of my observations.

1. Enhancing The Consumer Experience

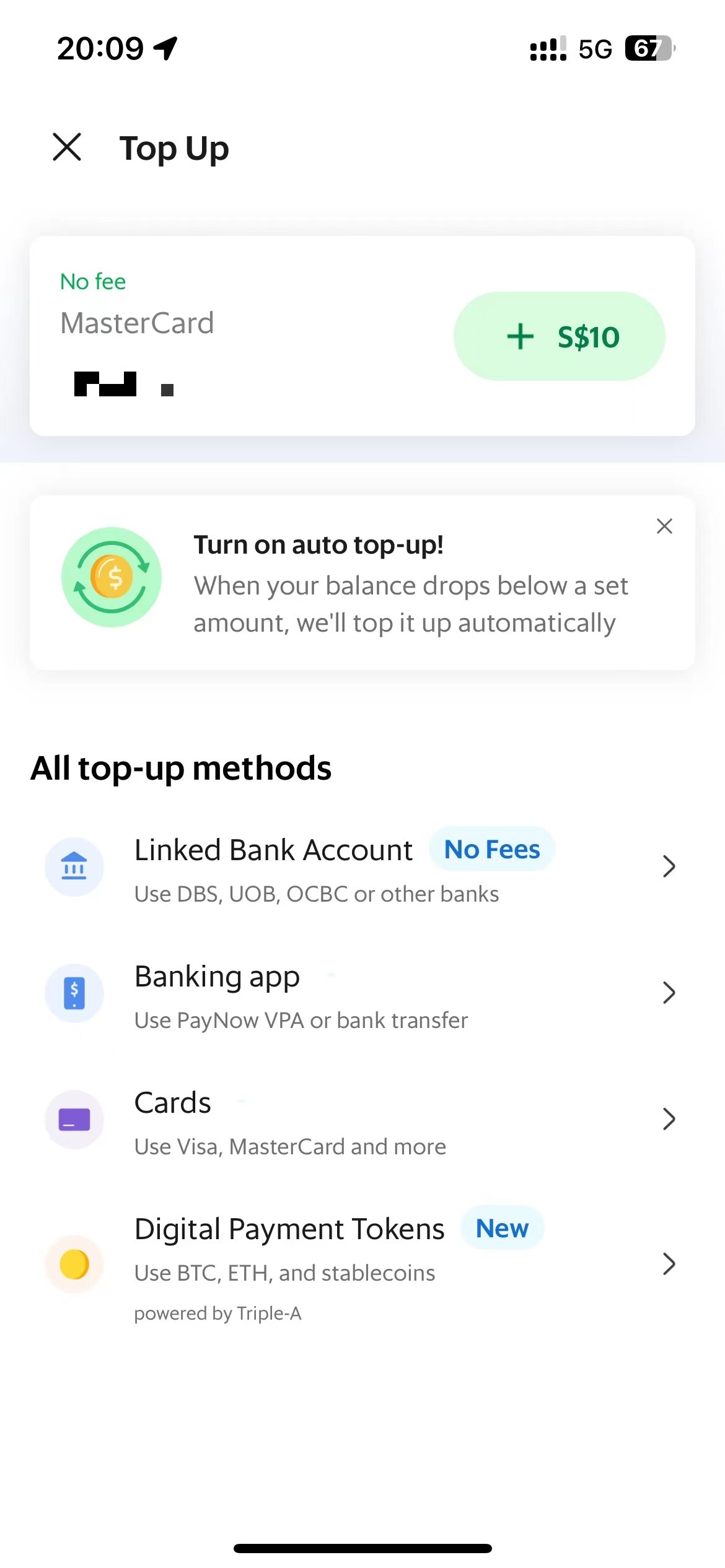

Curiosity piqued, I embarked on a trial run of this new feature, eager to uncover its value proposition for consumers. Does it offer a smoother payment experience, cost savings, or heightened security compared to existing digital payment methods? Well, there’s room for improvement. First, it’s not cheaper but actually more expensive for consumers. Unlike bank transfers, card payments, or PayNow, which are typically fee-free, crypto top-ups incur gas fees (the fee to validating transactions on a blockchain network) and fiat-to-crypto conversion costs.

(Linking with bank account, cards, and banking apps is fee-free, while cryptocurrency top-ups incur gas fees and fiat and cryptocurrency spread costs)

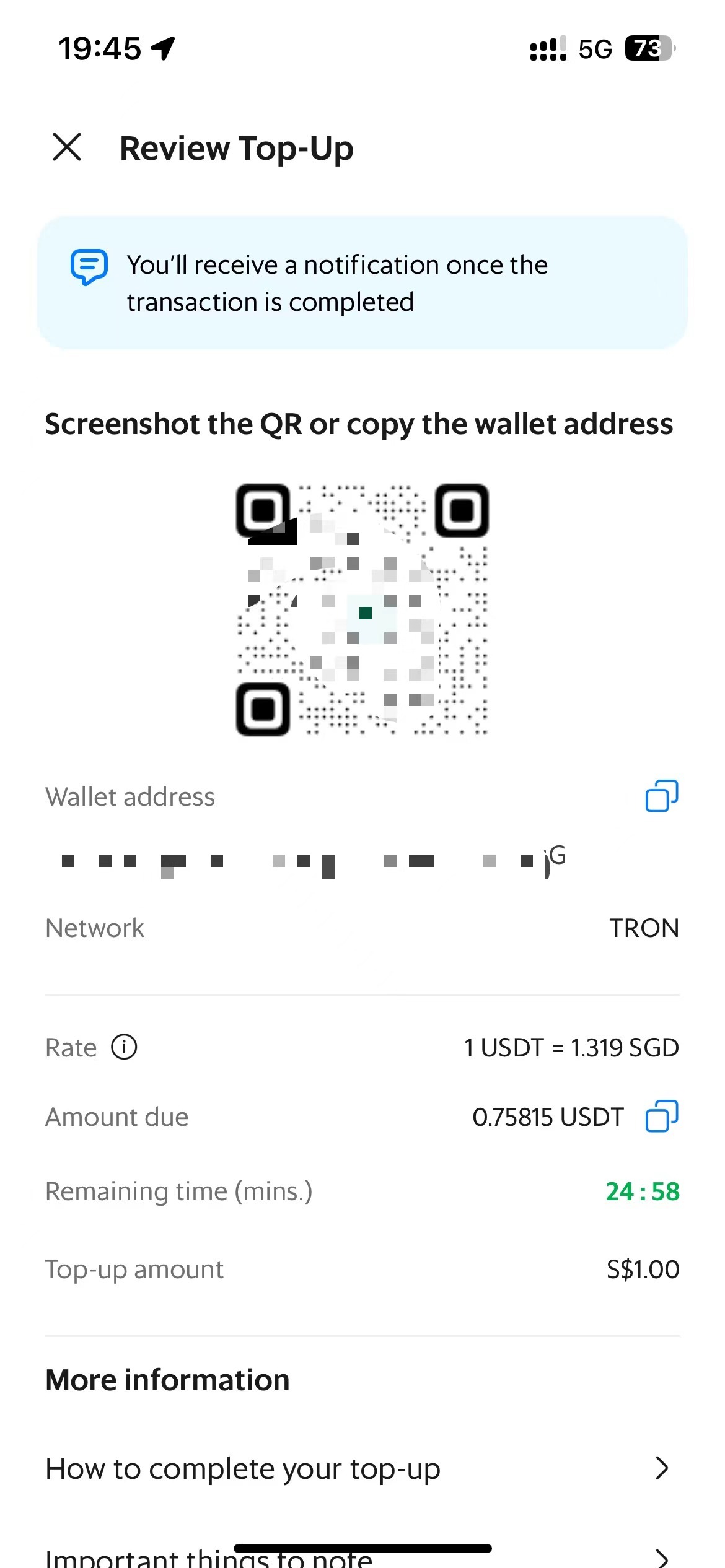

Second, I cannot tell that crypto transfer between crypto wallets is more convenient than a bank transfer between different accounts using PayNow or FAST. It’s actually more complicated, especially for crypto beginners. It includes switching between at least two crypto wallets, copying and pasting wallet addresses, checking that all information is correct, and going through multifactor authentication processes.

(Switching between different crypto wallets and copying and checking wallet addresses are not easy tasks for crypto beginners)

Furthermore, the “top up” process itself resembles an ATM deposit in the digital realm, lacking the seamless integration with direct links to bank account and credit/debit card without the need for topping-up seen in super apps in other regions such as with Alipay and WeChat Pay. In terms of security, the disparity between crypto and traditional digital payments is negligible. Nonetheless, for ardent crypto enthusiasts and traders, this feature presents an enticing avenue to utilize their assets in everyday transactions.

2. Empowering Merchants

Delving deeper, I explored the value proposition for merchants. While the allure of reduced costs and commissions associated with crypto payments is undeniable, it’s not the full picture. In this scenario, Grab assumes the role of the “merchant,” with Triple-A acting as the “acquirer” in a parallel to the traditional card-based retail payment model. By accepting crypto payments, merchants can circumvent the 2–3% interchange fees typically paid to card-issuing banks (a small percentage also goes toward acquirers and card networks). It’s essential to note that this doesn’t equate to fee-free transactions., however. The emergence of new “middlemen” in the crypto payment value chain introduces fiat-to-crypto conversion spreads akin to traditional foreign exchange rates. Merchants must weigh the comparative costs and, if the crypto route proves cheaper, consider passing on the savings to consumers through rewards, discounts, and innovative loyalty programs tailored to crypto payments.

Finally, though Grab’s new cryptocurrency payment feature is not perfect and still has space for improvement, as a regional super app and the second most used digital payment app in Singapore, according to Forrester’s Consumer Asia Pacific Survey, 2023, Grab holds strong potential to further build and expand its cryptocurrency payments offerings to broader ecosystems, such as by introducing new loyalty programs, advancing the digital payment experience, and integrating with future central bank digital currencies in the region. This will trigger more interesting innovations and alternative payment methods in APAC.

To learn more details about digital payments innovations in APAC and crypto and digital currency innovations, Forrester clients can read the following reports: The State Of Digital Retail Payments In Asia Pacific In 2023; The State Of Central Bank Digital Currencies In Asia Pacific; and Digital Asset Custody: A Primer. Clients may also schedule a guidance session or inquiry with me.