TIER: Venture For Advantage In Today’s Uncertain Economy

The economic landscape is extremely uncertain. Political control of both bodies of Congress for the next two years still hangs in the balance. The release of October consumer price index numbers, which had a lower increase than expected, has caused a huge rebound in a struggling stock market. But questions remain: Has inflation peaked? Or are these gains simply temporary?

Of course, this uncertainty is primarily a negative for executives making plans for 2023. They are forced to continuously adapt budgets and investment strategies to ever-changing funding constraints and competing interests. But for the bold executive, uncertainty also breeds opportunity. For example, valuations for late-stage startups are down 29% since the first quarter, meaning that a timely investment in the right business can offer huge potential benefits. And one way to approach these opportunities is through corporate venturing.

Corporate venturing, in which a company invests in early-stage businesses to gain access to a broader set of emerging technologies and capabilities to realize potential strategic or financial gain, has become an increasingly common investment strategy for companies seeking value creation. Nearly 100 of the companies in the S&P 500 index have corporate venturing arms, including 12 of the S&P’s largest 25 companies by market cap. Suzuki launched the corporate venturing fund Suzuki Global Ventures in October, while companies as varied as Chipotle, Booz Allen Hamilton, and Ulta Beauty have launched venturing funds this year.

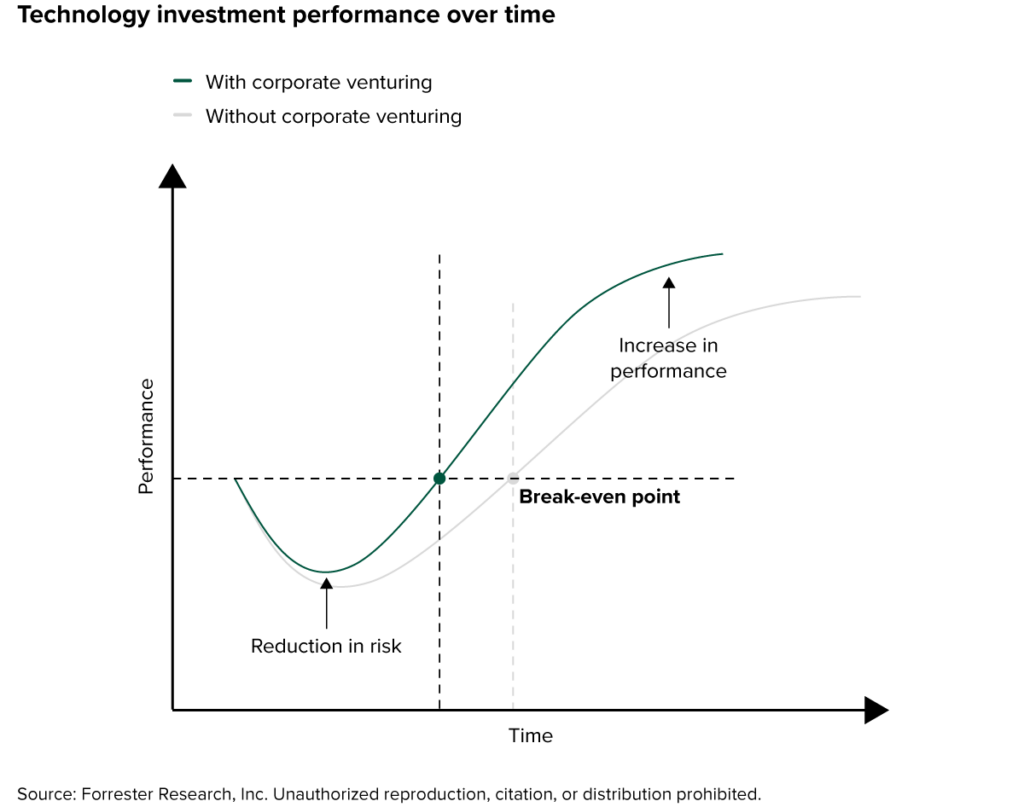

Corporate venturing allows firms to limit the downside and maximize the upside of technology investments (see figure). Venture-based investments are generally less operationally intensive and can be more easily halted than internal investments. And if venture-based investments fail, they will not do so due to the corporate pork-barreling and lack of operational latitude that traditionally constrain success. Upside, meanwhile, can be both financial and strategic. Venture-based technology investments can produce higher internal returns, return on investment, and impact to top and bottom lines. Strategically, venture-based technology investments improve market insights, access to technology, and scale of technology and capability delivery.

In other words, venturing is perfect for a time of economic uncertainty, when both risk and opportunity are highest. Rather than trying to build out an expensive internal capability, venture with a devalued early-stage business — you will get more bang for your buck and have a chance to back out if necessary.

All companies can venture — from Tata Consultancy Services to the US General Services Administration. And you do not have to start up an explicit corporate venturing arm to do so. Instead, use the principles of corporate venturing to minimize risk and maximize return in today’s economy. To see Forrester’s full recommendations for executives seeking to begin venturing, as well as venturing’s impact on technology investments, read my new report, US Tech Capital Investment In 2022. And if you want to chat about the evolving world of technology capital, feel free to schedule an inquiry or guidance session!

This research falls under Forrester’s tech insights and econometric research (TIER).