Slouching Towards Ubiquity: Five Notable Fintech Companies

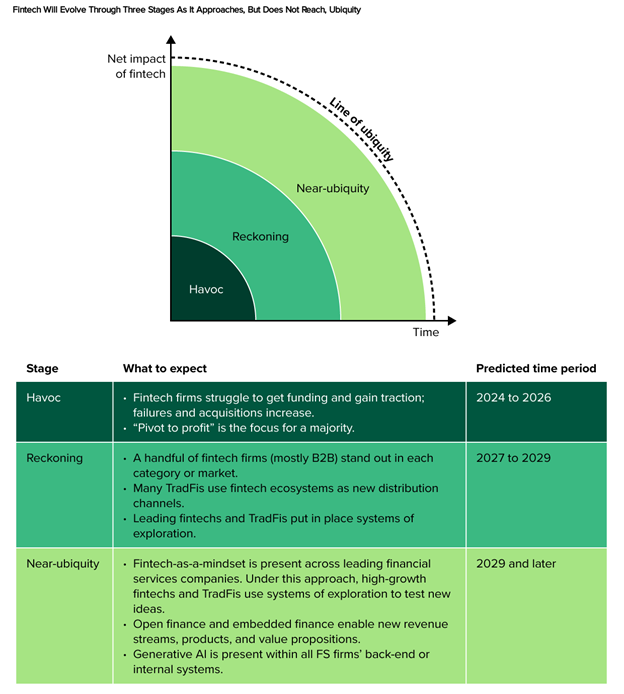

Fintech is slouching towards ubiquity (see image below). As it does, fintech will evolve into a broadly held mindset in contrast to being defined as a type of company, a specific set of startups, a category of product types, or a series of new business models. Fintech as a mindset will exist at a wide range of companies that drive sustained, profitable growth by exploring new ways to solve problems.

To illustrate some of the shifts that our research predicts and to highlight some companies embracing the “fintech mindset,” we present five notable fintechs and why you should care about them:

- Crew. Crew is brand-new (hey, that rhymes!). This direct-to-consumer (DTC) brand is a shared-finance fintech with a value proposition focused on banking products and experiences for families. Crew fills the unmet need for parents who are looking to simplify financial management and teach their children money skills. Others such as Zeta are designing financial products for families (we interviewed Zeta Founder and CEO Aditi Shekar for our latest research). Competition in this space will make breakthroughs tough. But tapping into this unmet (or, at least, undermet) need could mean big wins and sticky relationships with tens of millions of customers.

- Eisen. Eisen helps financial services providers and startups deal with dormant accounts and the escheatment process (offloading unclaimed property and assets to the appropriate entity). Talk about boring, right?! But as the self-described fintech theorist Alex Johnson once declared, “There is no problem too boring for fintech.” He’s absolutely right, and Eisen might just be a perfect case study: Its B2B model shows how effective it can be to focus on an extant problem and apply new technology and new thinking to solve it.

- Igloo. Igloo is another B2C fintech brand (it is in the minority in this list — we’ll explain why later) focused on insurance. Igloo illustrates the power of simplicity to drive growth in fintech: Its products and experiences are designed to reduce the cognitive load on end users, making insurance itself more accessible. Traditional financial institutions (FIs) and others should take note of Igloo’s creativity and product innovation: For example, the insurtech’s “Weather Index Insurance” combines data inputs such as rainfall with a proprietary parametric index to insure crops such as coffee.

- MO Technologies. This B2B fintech built a credit management platform that enables other firms to offer loans or credit cards. MO offers five standard types of lending and credit products: credit cards, “buy now, pay later” offerings, payroll advances, cash advances, and traditional installment loans. In addition, MO’s tools allow credit issuers (and soon-to-be credit issuers) to design and build a custom financial product on top of its platform. MO again illustrates the “unmet needs” attribute of fintech: It was built to serve geographies and markets that lack much in the way of credit infrastructure — and its model enables a wide range of other FIs to use something that they wouldn’t otherwise have wanted to build themselves.

- Sardine. Sardine is a B2B fintech (though it sells to nonfinancial companies, too). The firm was founded to offer superior fraud prevention and protection using AI capabilities. Fraud is one of those unsexy, yet hugely powerful, areas of financial services in which great fintech companies thrive: As Sardine’s head of strategy puts it, one of the firm’s central hypotheses is that “Nothing is more broken than how we [the industry] manage fraud and AML [anti-money laundering] in financial services.” Sardine uses emerging tech to solve problems that cost FIs, other companies, consumers, and governments trillions of dollars every year. Sardine also illustrates the “survivability” attribute of great fintech thinking: The problems that Sardine focuses on — and FIs’ need to solve those problems — will likely never go away. A company that can improve anti-fraud efforts will be around for as long as scammers try to perpetrate fraud on FIs.

It’s no coincidence that a majority of the firms we list here are B2B (or what I might start calling “B2FI,” since they primarily serve and sell to traditional FIs and other fintechs) — rather than firms that primarily serve and sell directly to end-user customers (be they consumers or businesses). This is because our research shows that B2C/DTC fintech brands will find survival and profitable growth especially hard to come by for the foreseeable future.

For more research findings and insights, please check out The Future Of Fintech (a long-form report on the forces reshaping the fintech landscape in coming years) and The Future Of Fintech: Emerging Opportunities For TradFIs (a companion report outlining how traditional financial institutions are approaching — and how they should approach — the fintech space). Or contact me at pwannemacher@forrester.com if you want to discuss fintech trends!