Amazon sailed past expectations for its third fiscal quarter as the company continues to meet rising demand for its products and services amid the global pandemic.

The company posted record revenue and profit, despite spending billions on COVID-19-related initiatives and hiring hundreds of thousands of workers. Amazon incurred another $2.5 billion in costs related to COVID-19 in the third quarter — $500 million more than expected — after reporting $4 billion of costs in the second quarter.

The company said today it will incur another $4 billion during the fourth quarter. The COVID-19-related cost includes expenditures to help keep employees safe; additional pay for workers; and for more delivery capacity.

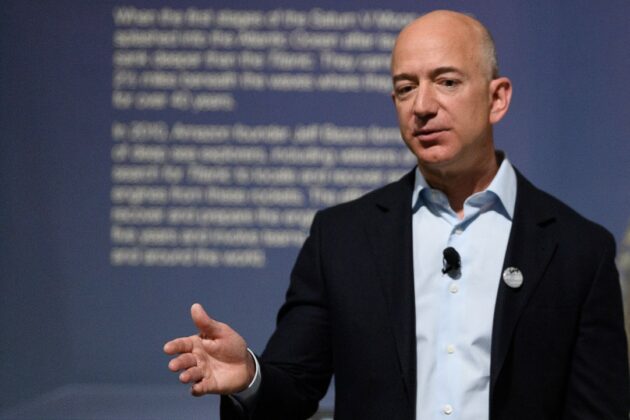

In his prepared statement, Amazon CEO Jeff Bezos focused on the company’s job creation, noting that it has created more than 400,000 jobs this year.

“Two years ago, we increased Amazon’s minimum wage to $15 for all full-time, part-time, temporary, and seasonal employees across the U.S. and challenged other large employers to do the same,” he said. “Best Buy and Target have stepped up, and we hope other large employers will also make the jump to $15. Now would be a great time. Offering jobs with industry-leading pay and great healthcare, including to entry-level and front-line employees, is even more meaningful in a time like this, and we’re proud to have created over 400,000 jobs this year alone.

Here’s a quick breakdown of the company’s financials.

Revenue: Amazon posted $96.1 billion in revenue, up 37% from the year-ago quarter. Analysts expected $92.7 billion.

Profit: Amazon reported net income of $6.3 billion, or earnings per share of $12.37, crushing expectations of $7.41, and up from $4.23 last year. Operating income came in at $6.2 billion, up from $5.8 billion in the second quarter, and up from $3.2 billion in the year-ago quarter.

Stock: Shares were down slightly in after-hours trading. The company’s stock is up 90% since March and was trading at around $3,230/share on Thursday before the market closed. Amazon’s market capitalization has risen to $1.6 trillion, right alongside Microsoft. They trail Apple ($2 trillion) for the title of most valuable publicly-traded U.S. company.

Outlook: Amazon expects Q4 sales between $112 billion and $121 billion, up 28-to-38% year-over-year. Operating income is projected at $1 billion to $4.5 billion.

Amazon Web Services: Amazon’s cloud business was up 29% at $11.6 billion, with $3.5 billion in operating income, continuing to help drive Amazon’s profits. The AWS revenue growth rate stayed stable from the second quarter but was down from last year (35%).

Shipping costs: Amazon’s shipping costs have ballooned in recent years as the company aims to speed up delivery with its push for one-day shipping. During Q3, Amazon spent $15 billion on shipping, up 57%. Amazon CFO Brian Olsavsky said the company will grow its fulfillment capacity by 50% this year. “That’s a significant step up in our capacity,” he said on a call with reporters Thursday.

Physical stores: The category, which includes Whole Foods and Amazon Go stores, posted revenue of $3.8 billion, down 10%. Olsavsky said online grocery delivery is “doing really well” and growth continues to accelerate. Online grocery sales tripled year-over-year in Q2.

Advertising: The company’s growing advertising arm doesn’t have its own category, but makes up a majority of the revenue under a category called “Other.” That category brought in $5.4 billion in revenue in the quarter, up 51% over a year ago.

Headcount: Amazon now employs a whopping 1.13 million people, up 50% year-over-year. That figure, which crossed 1 million for the first time, does not include seasonal and contract workers.

Prime: Subscription services revenue, which includes Prime memberships, came in at $6.6 billion, up 33%. Amazon said it had more than 150 million Prime members in January; it has not provided an updated number since then. Olsavsky said Prime member renewal rates improved in the quarter compared to last year. He also noted that Prime member “engagement” is going up. “We think that will have lasting value,” Olsavsky said.