Apple’s Partnership With Goldman Sachs Will Drive Seismic Shifts In The Banking Industry

Forrester IT

MARCH 26, 2019

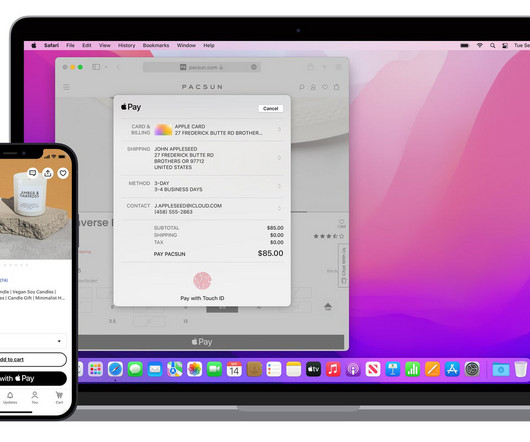

Apple and Goldman Sachs are partnering to deliver a new credit card. The bigger concern for digital banks, traditional banks, […]. The industry seems to be quick to dismiss the partnership, especially the rewards program – but we think they’re missing the bigger picture.

Let's personalize your content