Unleashing the power of banks’ data with generative AI

CIO Business Intelligence

FEBRUARY 16, 2024

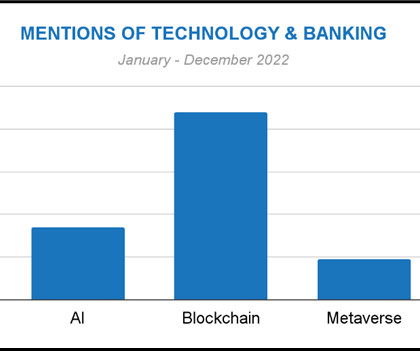

The implications of generative AI on business and society are widely documented, but the banking sector faces a set of unique opportunities and challenges when it comes to adoption. If banks are to put their faith in AI, then transparency will be key to building trust. This is a problem banking leaders are increasingly aware of.

Let's personalize your content