The ESG Data And Analytics Market Is Changing Rapidly

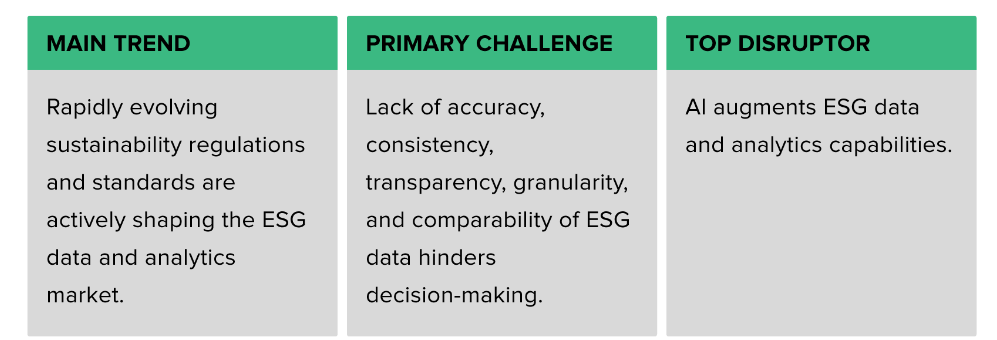

Sustainability has become a strategic and operational imperative for many organizations. Investment, sustainability, and risk professionals increasingly integrate environmental, social, and governance (ESG) factors into investment analysis and decisions as well as third-party risk management — often to meet regulatory requirements. Many are turning to ESG data and analytics providers to help with those efforts, resulting in considerable growth and consolidation of this market in the past 24 to 36 months. Solutions are becoming more mature and sophisticated — though key challenges remain.

What Do ESG Data And Analytics Providers Offer?

ESG data and analytics providers help organizations assess the corporate sustainability performance of companies, assets, or funds — extending to supply chains. In The ESG Data And Analytics Providers Landscape, Q1 2024, we define ESG data and analytics providers as offering:

Solutions that assess the corporate sustainability performance of companies across environmental, social, and governance factors and that provide ESG data and analytics to inform investment decision-making or manage third-party and supply chain risks.

All the vendors featured in this landscape let users access and analyze ESG data. Beyond these core use cases, ESG data and analytics providers can also (but not systematically) address the following extended use cases: enhance investment decision-making; track and benchmark ESG performance of investments; measure and reduce financed emissions; identify ESG-related risks in the supply chain; find ESG-related risks in the third-party ecosystem; inform lending decisions; create sustainability-focused investment products; and comply with ESG regulations and reporting requirements.

Of the 17 ESG data and analytics providers included in The ESG Data And Analytics Providers Landscape, we will only evaluate 12 in the upcoming Forrester Wave™ report, using Forrester’s flagship vendor evaluation methodology.

ESG Data And Ratings Suffer From Key Challenges

Currently, the lack of accuracy, transparency, comparability, and granularity of ESG data hinders decision-making. ESG ratings often don’t meet investors’ needs, as they vary substantially across providers in terms of their scope, objectives, and assessment methodology; rely on backward-looking data and subjective interpretation; and lack strong and transparent governance processes — which potentially leads to conflicts of interest.

Regulators and industry bodies are responding to address these concerns. The International Capital Market Association and the International Regulatory Strategy Group have recently launched a voluntary code of conduct for ESG rating and data product providers, which aims to promote transparency, good governance, and management of conflicts of interest, as well as to strengthen systems and controls in the sector. Meanwhile, the Monetary Authority of Singapore has published its Code of Conduct for ESG Rating and Data Product Providers, and the European Council has reached an agreement on a proposal to regulate ESG rating providers.

A Market Growing In Sophistication

Vendors in the ESG data and analytics landscape are pursuing various approaches to innovation and have taken several paths to drive growth, ranging from private equity investments to strategic acquisitions. This established market has consolidated to produce a handful of large providers that dominate the market. With new regulations and standards raising the bar for disclosures — and investors needing robust and reliable climate data to deliver and credibly report on their net-zero commitments — the ESG data and analytics market is also expanding in terms of data types and breadth of data. Meanwhile, a flurry of new entrants are leveraging emerging technologies to innovate, address specific gaps in data coverage, and let users customize ESG analytics.

Choose The Right ESG Data And Analytics Provider(s)

Selecting an ESG data and analytics provider — or providers — is a significant investment of time and resources that can have an outsized impact on your organization’s results. ESG data and analytics providers vary by size, type of offering, geography, and use case differentiation. With so many providers, it’s important to choose the right one based on your specific needs. Read this landscape report to understand the value that you can expect from an ESG data and analytics provider, learn how providers differ, investigate options based on size and market focus, and create your shortlist. If you’re a Forrester client going through that selection process and would like to discuss it with us, please reach out via inquiry@forrester.com.

Many thanks to Lok Sze Sung and Hannah Bradbury for their contribution to this project.