As companies shift priorities out of fear of recession, there may be chances for technology that once got little attention to find new life.

While big tech sheds staff and the rest of the market braces for the possibility of another downturn, venture capitalists continue to look for tech that may be in demand regardless of the economy.

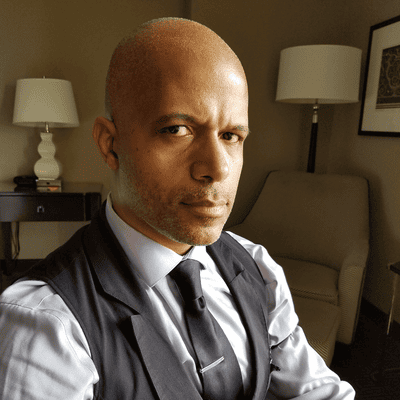

Bryan Offutt, partner with Index Ventures, focuses on investments in such areas as security, data, machine learning, and traditional application infrastructure with open source acting as a common thread for him. Self-described jokingly as a “washed-up software engineer,” Offutt shared some insights with InformationWeek on technologies he is paying attention to and what areas of innovation may retain relevance as the market sorts itself out yet again.

We’re in a curious time right now. Big Tech is shaking out staff and other companies -- even those not specifically in tech -- are following suit. In the midst of all this, how do you process what is happening and focus your attention for investments?

There are the areas that you’re looking at from a net-new investment perspective and then there’s how you’re advising your portfolio companies through what is a pretty turbulent period of time where obviously the market has changed dramatically. Certainly, for the companies that have started in the past three years, this is a pretty big shift. On the net-new investment side, it’s really a return to “keep it simple.”

From 2020 to 2021, there was a tremendous amount of momentum and hype investing where you would see, in my area, a bunch of GitHub stars on a project and people would go, “Oh, great. GitHub stars. Invest,” without thinking through who was starting it, how much money does that person have, what problem is this actually solving, is this a cool thing where people might go, “Oh, that’s neat.” Or is this a thing where people are going, “Actually that’s solving a very painful business problem for me that could create operational leverage within my organization.”

Focusing in on what is the actual value driver of this product, particularly in B2B where now you have buyers who are really thinking very, very hard about every dollar, so if the amount you use to have to add was “this” big, it’s now “THIS” big and the only companies I think can really succeed are the ones that are providing this pretty big shift in cost savings and revenue driving.

I think there’s a lot of distraction in the market still. I think the area where I have the most long-term confidence, but is the most short-term noisy, is in AI.

In the last couple months, there’s been a lot of buzz around a technology that’s been making really interesting progress for many, many years. It’s just been packaged and marketed over the past six months in such a way that the average person can go, “Wow, that’s neat,” which I think has resulted in a bunch of investment dollars pouring into things that are neat but may not actually drive a tremendous amount of business value.

So, staying focused again on not where the hype is, not what people are talking about, but where there is leverage being created -- which is often actually way more boring.

Can you speak about areas that have been of interest to you and how that has compared with the hype cycles? How do you separate the frothiness from the technology?

I split my time from a new investment perspective into two very, very broad categories. One is what has changed in the past one to two years, whether it be from a market perspective, whether it be from a technical landscape perspective, whether it be from a labor perspective that’s driving a shift in thinking for particularly how large enterprises think about buying and what they need. That’s the more boring, on the ground stuff.

And then I think, what are interesting areas that are maybe more nascent today but could have tremendous upside over the next three to five years. I try to spend my time sort of 50 - 50, and if you have a nice portfolio balance, obviously there is more risk in the second category with potentially more upside. The first category is more like a known problem.

For the first one, what I’m thinking about is given the change in the market environment, what is changing about the psychology of your buyer? How does that expose net-new opportunities in spaces you already know people are spending dollars? It’s very hard to get people to spend new dollars. It’s comparatively easy to get people to spend a dollar over here instead of a dollar over here.

I think within large enterprises in the spaces that I look at, the No. 1 thing people are waking up to is usage-based pricing can be extremely expensive. That’s particularly true of data systems where over the past few years people have just been pouring data into it. Now we’re waking up and saying, “Oh, my goodness. I’m spending so much on my Snowflake bill or my Databricks bill.”

I’m spending a lot of time looking at technologies that allow the enterprise customer base to store and query data in a more cost-effective and more long-term flexible way.

I think there’s also lot of opportunity in categories that over the past five years haven’t been of interest to investors. So many companies were focused on topline growth that any sort of product that was selling a cost savings narrative -- most companies were like, “Eh, that’s not like a huge concern.” Versus now where it matters a lot. Things like cloud platforms that allow you to understand where you are spending across your cloud bill, optimizing that spend, all of that is super top-of-mind for folks and a good opportunity for companies to come in and sell cost savings rather than revenue generation.

On the net new stuff, I think it is still the machine learning and AI side of things. The way I’ve been thinking about it myself is, the upside of all the awareness [AI is] getting means that while right now most of the companies that are cropping up are sort of if you and me got into a room for 30 minutes and we’re like, “What’s the most obvious set of things to use these models for?” which I think makes it hard for them to be long-term differentiated.

I think in a year, people will have had enough time to really sink in and think through, “What could I use this for that’s really interesting?” I’m tracking over the next year, year-and-a-half, to see when the real product builders pop up to say, “Hey, here’s a really interesting business problem that this thing can solve.”

Are there any other areas of technology that have been percolating for quite some time and now is the time for them to manifest their potential?

I do think machine learning and AI fall in that category. We started investing in the category a couple years ago -- it wasn’t a super heavily invested-in space because people were like, “This is really interesting, but you need this really expensive team that’s hyper-specialized to do anything interesting with it. That labor force is super expensive and hard to come by.” So, you only have the largest companies actually leveraging this stuff in any super meaningful way. It’s a huge competitive advantage for them.

I think the supply of students graduating with degrees in machine learning and artificial intelligence has exploded. And the barrier to using these tools has dropped dramatically. You can take an open-source model off of GitHub or Huggy Face and do something pretty interesting with very limited knowledge of actual machine learning. What that enables is you no longer have to be a machine learning expert to leverage these models to do something. You could be an average software engineer. That’s quite a powerful shift.

What to Read Next:

How Will the AI Bill of Rights Affect AI Development?

VC and Analyst Notes from FinovateFall on the Future of Fintech

About the Author(s)

You May Also Like