As big tech sheds employees by the thousands, could this be an opportunity for other companies to recruit the talent they craved to drive innovation?

Through layoffs, firings, and mass resignations, some major players in tech and social media parted ways recently with thousands of employees, putting a flurry of tech talent back on the job market.

These new expatriates from companies such as Meta, Twitter, and Amazon may have expertise in areas other businesses might want in their ranks. A long-running concern among enterprises has been a shortage of tech talent to not only fill out their teams but drive innovation from within. Experts from Gartner and HackerEarth shared some of their perspectives on what may unfold as tech pros from big tech look for new opportunities.

The solution to everyone’s woes might not be as simple as connecting job listings with engineers and IT leaders fresh out of Twitter and other companies. What if organizations that want to hire such talent do not have deep enough pockets to meet their salary expectations? What if the type of work on the table does not appeal to them? Not everyone is a rockstar developer or engineer, but many just came out of jobs with well-known names in tech that -- at least in the past -- represented dream opportunities.

Though big tech is cutting staff, the need to innovate remains. “There is no slowing down in terms of transformation,” says Lily Mok, vice president and analyst with Gartner. Technology investment continues to be on the rise from a budget perspective, she says, citing her firm’s CFO research, and might even serve as a means to escape downturns. “The skillsets required to deliver against that will be a key thing for looking at what are the skills that, as a result of the layoffs, will be on the market,” she says.

People-Centric View on Employment

Organizations looking to make hires from among recently displaced tech professionals will need to work harder to differentiate their positioning beyond compensation, Mok says. There has been a drive in recent years for a more people-centric view on employment, she says, which goes into the overall experience new hires are looking for. This could give hiring companies a chance to show the stability they can offer to tech professionals who are unsure about the future, she says.

“They value growth opportunities,” Mok says. “Some IT tech talent candidates are willing to trade off 10% of pay for flexibility and career growth opportunities.”

There has been a sea change in the prospects certain big tech players anticipated would continue to buoy their sector. Sachin Gupta, CEO of HackerEarth, says many big tech and social media platforms saw explosive growth when the pandemic changed spending patterns and drove moves to work remotely and conduct more activities online. “What the businesses started thinking was this was going to last forever, which is very natural,” he says. It is very difficult to be in the midst of such a wave, he says, and then predict that it would not continue.

The reasons behind the recent layoffs and firings differ, of course. Meta’s troubles include not seeing expected traction -- such as its exploration of the metaverse. Meanwhile, Twitter is in the throws of a regime change that has been acrimonious for at least some of the rank and file of the company, which has seen sweeping layoffs, resignations, and outright firings of personnel new CEO Elon Musk no longer wanted to darken the company’s door -- office doors that Musk abruptly ordered to be shut (temporarily) and locked last week even to remaining employees.

Gupta says the shifts in the market has meant a reprioritization for companies with inefficiencies under greater scrutiny. In Meta’s case, laying off 11,000 people represented a 13% staff reduction, but he says the company remains substantial with some 87,000 employees still at the company. “They will continue to innovate but I think they will be more selective about their bets,” Gupta says.

It is possible that some former employees of tech players might try their hands at founding their own companies. “Times like these are actually very ripe for a huge influx of early-stage companies,” he says. Venture capital and other investors who shy away currently from growth and later-stage funding rounds might have an appetite for more digestible investments, Gupta says. “It’s easier for them to deploy smaller check sizes.” That could mean more seed and series A rounds to back newcomers in the startup scene, he says.

Deeper Pool of Potential Hires

Pressure created by talent shortage in tech could ease off with the now deeper pool of potential hires, Gupta says, which might benefit hiring companies. “If you look at the classic enterprise -- your consumer goods, banking, hardware and engineering -- these sectors are not slowing down,” he says. For some of these companies, which were not traditionally technical or software-driven in the past, it was harder to compete with big tech for talent some 12 months ago, Gupta says. “That’s changing. There are fewer jobs in big tech, which means talent will naturally get redistributed to some of these traditional industries.”

Many of those industries have been working to become software-driven, he says, and have solid business models. “These companies need tech talent. We haven’t seen a slowdown in demand from traditional enterprises,” Gupta says. “That is where the second wave of innovation will come from.”

Getting that talent to fill jobs in other industries may take a bit of recalibration to this new reality. “I have a little bit of an unpopular opinion, but I do feel the job market was unnecessarily too hot,” he says. Salaries got bloated while supply and demand were skewed, Gupta says. “We’re going to see some correction in that, which was merited.”

That does not necessarily mean drastic pay reductions across the board, he says, but salaries could dip by a few percentage points. “A lot of tech talent is already very handsomely compensated,” Gupta says. He expects hiring negotiations to change with more competition among candidates for available jobs. Those candidates might, in turn, spend more time trying to understand the companies they might join and the type of work they may take on.

Putting the recent headlines into perspective, Gupta says there are some 3 million to 4 million IT developers in the workforce in the United States. The recent layoffs and firings among big tech companies might number collectively below 100,000 individuals so far, and not all of those were tech employees. “I really don’t think that’s going to create a huge wave,” he says. Still, the redistribution of talent may change the fortunes of companies that hire the tech talent that is becoming available.

What to Read Next:

Facebook Parent Meta Lays Off 11,000: What CIOs Should Know

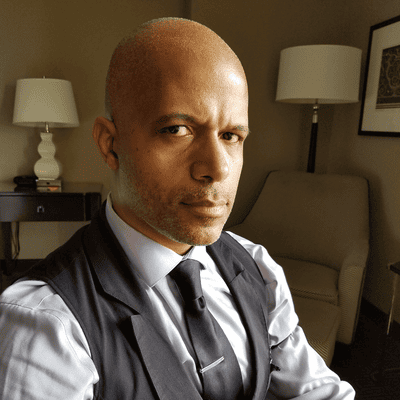

About the Author(s)

You May Also Like