The B2B Content Guide: Make Sales Your Ally In Content Marketing

This is the fifth installment of a five-part blog post that makes up The B2B Content Guide. In this series of blogs, Forrester used existing B2B marketing research and data from our 2021 Content Preferences Survey to provide marketers with best practices for creating content and content strategies.

B2B buyers are often overwhelmed by the volume of content they receive from sellers but underwhelmed by the content’s quality. Sales reps play a critical role in streamlining relevant content for prospects. Three-quarters of tech buyers say that it’s important for sales reps to provide only relevant content that is tailored/personalized to them. They also expect sales reps to continue the conversation that began with the reps’ companies’ marketing messages and content. Simply helping sellers put content in front of prospects is not enough; sales reps need the ability to customize how they present content in order to personalize the conversation with clients/prospects.

Make The Sales Team Your Ally In Every Step Of Content Marketing

An estimated 65% of the content marketing assets produced go unused because they are irrelevant. One reason for this is that marketing teams often don’t understand how sales teams interact with buyers; hence, they end up creating content that is difficult for sales reps to use. To bridge the gap between sales and marketing, B2B marketers must take a cross-functional approach and learn to connect their content and messaging with the way sales engages with buyers.

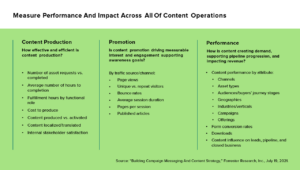

Measure Performance And Impact Across All Of Content Operations

Too few B2B marketing organizations can segment and surface meaningful, cross-functional content performance insights to drive informed content-strategy decisions. Marketers need to build an effective content-performance dashboard that provides insight into each stage of content operations and allows them to drill into the specific attributes (e.g., topic, asset type, audience, channel, etc.) of what is and what isn’t driving engagement and supporting business goals.

Note: All data points in this report come from Forrester’s 2021 Content Preferences Survey, conducted in October 2021, for which we surveyed 655 technology buying decision-makers globally: 33% were in North America; 33% were in EMEA; and 34% were in Asia Pacific. It was a cross-industry study, including companies with at least 500 employees. All respondents were leaders (manager level or above) who were involved in a technology purchase of at least $10,000.