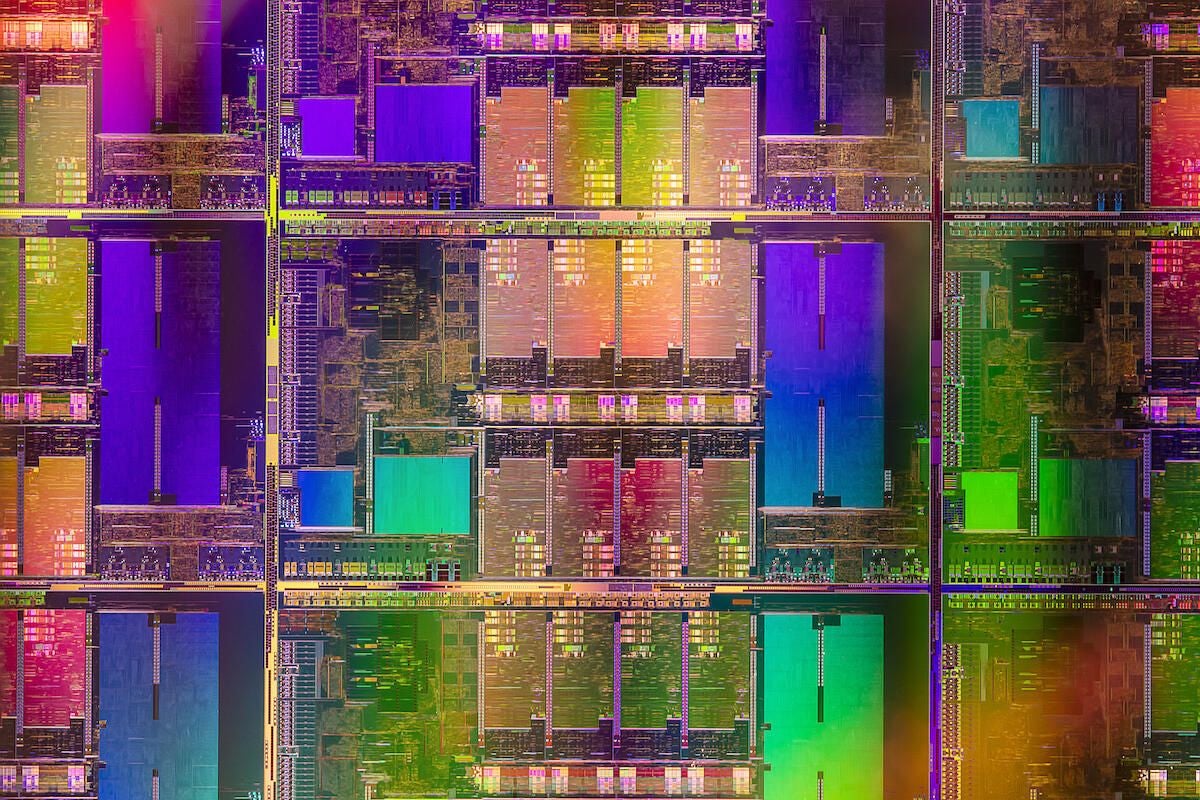

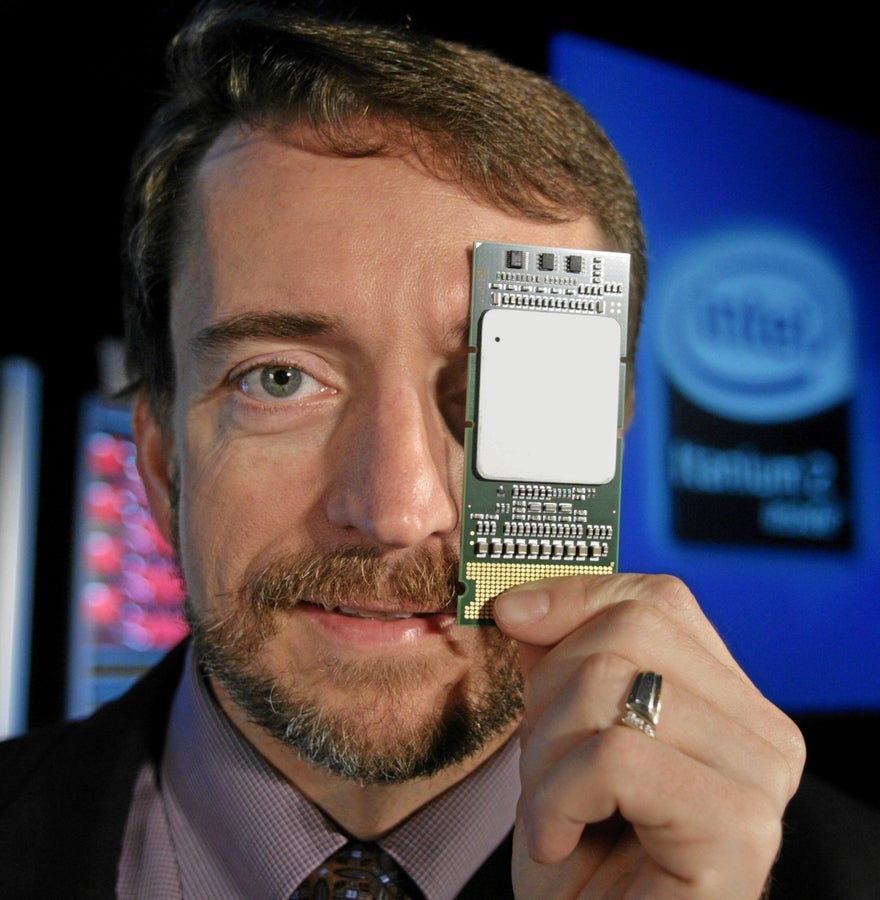

Image: Intel

One takeaway from Apple’s recent “Unleashed” event is that Intel has fallen way, way behind in terms of personal computers. Apple’s ARM-based M1 chips blow Intel’s x86 chips away in performance.

Intel’s apparent slide into obsolescence was somewhat obvious well before Apple’s event, given that Intel kept missing out on mega trends like mobile computing, even as it has posted impressive revenue growth in Internet of Things and remained relevant to cloud data center build-outs. Intel’s place in the cloud, however, remains at risk as AWS and others design ARM-based chips (Graviton 2, in AWS’ case) that promise much better performance at a lower cost.

SEE: Change control policy (TechRepublic Premium)

Image: Intel

Small wonder, then, that while Intel was one of the 10 largest companies by market capitalization in 2001, it has fallen off that list today, with direct or quasi-competitors taking its place (including Apple, Microsoft, Alphabet/Google, Amazon, TSMC and Nvidia).

Against this backdrop of doom and gloom is Intel’s intent to spend its way back to greater market share. It just might work, as Dylan Patel, chief analyst at SemiAnalysis, has outlined. In fact, spending big may be the only way Intel can reclaim its crown.

Increasing the CapEx

When former VMware CEO Pat Gelsinger took the reins as Intel CEO in February 2021, it might have been tempting for him to take a cautious approach. But by July 2021, Gelsinger was assembling the media (and his troops) to lay out an ambitious plan to build out its foundry business (to manufacture chips for Amazon and others), drive technological innovation and increase capacity. As Gelsinger said on the company’s most recent earnings call, “Near term, we could have chosen a more conservative route with modestly better financials. But instead, the board [and] the management team…[chose] to invest to maximize the long-range business that we have.”

That investment wouldn’t be cheap. Rather, the company plans to spend upwards of $25 to $28 billion each year on capital expenditures, as well as $15 billion on R&D. Since Gelsinger’s appointment as CEO, the company has hired another 6,000 engineers. All of that resource is intended, Gelsinger said, to yield performance parity in 2024 and industry leadership by 2025. It’s hugely ambitious.

Or “insane,” according to Patel:

“Intel’s plan just feels insane to us. ‘5 nodes [new chips] in 4 years.’ After the firm struggled on the 14nm replacement for nearly a decade, to believe they can execute on this vision takes a whole lot of Kool-Aid. What we can believe is that Intel will spend a lot on wafer fabrication equipment… . Pat will take the lower margins, but instead of figuring out how to cut costs like all prior leadership since and including Paul Otellini, he is willing to potentially light money on fire.”

Not that the company has much of a choice. Yes, continued Patel, “Intel could follow the path of many other American Goliaths” on a “slow slide to irrelevancy, spinning off business.” Instead, he noted, “Pat Gelsinger and Intel are saying no to this.” They’re making big bets–bets that might not pay off–but the alternative is that “slow slide to irrelevancy.”

Over in public cloud land, Google, Microsoft and AWS have continued to spend billions upon billions to stoke and keep up with customer demand. In fact, those data center build-outs have contributed to Intel’s financial success in its most recent quarter. Other cloud providers, like Oracle, have spent dramatically less, as Charles Fitzgerald, an analyst with Platformonomics, has detailed. In some markets you don’t get to compete without spending a lot of money on CapEx (or piggybacking on a provider who does). Chips are one. Cloud is another.

In Fitzgerald’s estimation, “CapEx tells us several things about cloud businesses: whether you have actual customers, whether you’re ready for new customers, and how you’re keeping up with the competition. On all three counts, Oracle’s CAPEX tells us the company isn’t playing the hyper-cloud game.” I wrote about this in 2017, the year that Oracle’s CapEx spending for cloud plateaued. It hasn’t improved.

This isn’t really a critique of Oracle so much as praise for the bold move Intel is taking. According to Patel, Intel’s CapEx spending is “perhaps the riskiest bet in technological history.” That might be an overstatement, but he’s not wrong that Intel’s investment means it’s way too soon to write the venerable chip company off.

Disclosure: I work for MongoDB, but the views expressed herein are mine alone.