Financial Services Firms Need To Learn How To Earn Customers’ Trust

How successful have financial services firms been in garnering the trust of their customers amidst inflation and market volatility? Not very successful, it seems.

Forrester’s Financial Services Customer Trust Index, which measures how much customers trust their banks, credit card issuers, investment firms, and insurance companies, found trust to be relatively weak among customers of financial services brands in 2022. For example, in the US, around one-third of customers indicated that they had high trust in their financial services provider, yet just over half indicated that they had low trust in their provider.

Why Does Customer Trust Matter?

Earning customer trust is an imperative. Financial services firms simply can’t operate without it. When customer trust is strong, financial services firms reap financial, competitive, and reputational benefits, enabling them to expand and extend customer relationships. When it is weak, they lose those benefits and have to fight harder to win business.

Our data shows that there is a large trust outcome gap, which exposes the potential business impacts that can occur when customers start making decisions based on their trust. For example, variances in levels of trust can impact customers:

- Recommending the brand to family and friends. Ninety-three percent of US banking customers with high trust in their primary bank say they would recommend it to friends and family. Only 39% of customers with low trust would do the same.

- Opening another account with the company. Ninety percentof US banking customers with high trust in their primary bank say they would open an account with it again. Only 34% of customers with low trust would do the same.

How Do You Measure Trust?

While most financial services leaders understand the importance of trust, they lack a clear understanding of what drives customer trust and how to measure it. Even if your firm has been in business for 100 years and has trillions of dollars of assets, it doesn’t mean that customers trust you. Trust is in the eye of the beholder. You can’t assess it yourself, nor can you rely on your gut instincts or assumed notions of what constitutes trust.

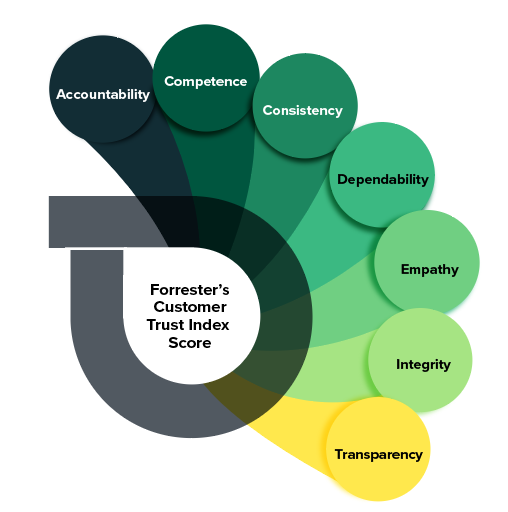

To help financial services brands measure their ability to earn customer trust, we developed Forrester’s Financial Services Customer Trust Index. This methodology is built upon Forrester’s seven levers of trust and gives brands the data and insights they need to assess customer trust, to understand how to earn it, and to prioritize initiatives that ultimately drive revenue.

The Key To Earning Customer Trust Is To Understand Your Unique Blueprint

We found a unique blueprint for customers’ trust in financial services firms that differs in every country and for every firm type. For example, dependability is the most important factor to earn trust for US and Canadian banks, and empathy is the second. For US investment firms, however, dependability is the most important, and competence comes in second. Firms can use this trust blueprint to uncover opportunities such as the empathy opportunity that exists for US and Canadian banks. Only 54% of customers in the US (and 50% in Canada) believe that their primary bank exhibits empathy, a primary lever of trust.

Drivers unique to banking, credit cards, investment, and insurance, like doing what’s best for the customer, help us understand customers’ perceptions of trust and what influences it. We found that firms performed worst on the top drivers of trust (according to their customers) but that poor performance opens opportunities for firms to both understand and drive efforts to improve trust.

Trust Is Hard To Earn And Easy To Burn

Trust isn’t abstract — you can earn and strengthen it. Earning trust is hard, because a broad range of customer perceptions and experiences accumulate over time to produce it. Losing trust, however, is easy.

Firms must design and execute deliberate strategies to earn more trust from their customers. But first, they must stop guessing and 1) measure customers’ trust in their brand and 2) understand what drives that trust. Although data alone can’t tell business leaders what and how to improve, there are many ways that they can use data to identify opportunities to earn trust and to avoid damaging it.

To learn more, check out these Forrester reports: Introducing Forrester’s Financial Services Customer Trust Index and The US Financial Services Customer Trust Index Rankings, 2022.