Third-Party Providers Want In On The Retail Media Boom

Retail Media Is Booming

I’ve taken more questions on retail media in the past 12 months than any other digital marketing topic that I cover. And it shouldn’t be any surprise, as consumer purchasing and behavior has significantly shifted online during the pandemic. We had already noted growth in retail media in the middle of the pandemic, but now it’s a full-on boom, as:

- Brands spent at least $5 billion on retail media in 2020. That’s not a typo. We estimate based on our latest retail media research that enterprise advertisers spent at least $5 billion in retail media networks such as Amazon, Target, Walmart, and others in 2020. Why? Because consumer packaged goods brands, consumer electronics brands, and many other brands that sell through retailers want to influence the customer at the digital point of sale. Retail media helps them do just that, as well as be able to better measure performance from their investments.

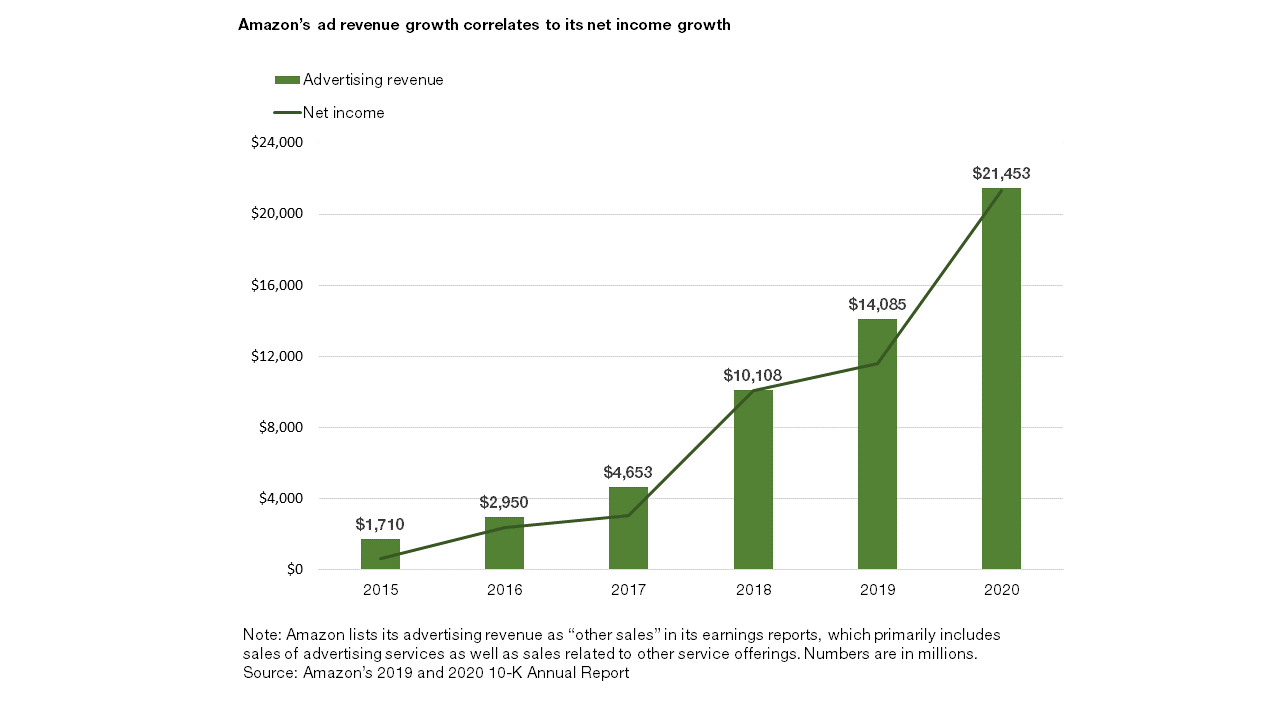

- Retailers double-dip on e-commerce growth. Retailers have seen sizable growth in e-commerce during the pandemic, and retail media offers them a chance to double-dip by also monetizing the shoppers on their site — even if they don’t purchase. Amazon was first to the retail media game when it built its ad capabilities back in 2011. Now, retailers from CVS to Home Depot to Kroger to Dollar Tree have their own media networks. And it isn’t likely to stop, as it will only grow across retail sectors and the world. Why? Because retail media gives retailers a new revenue stream by monetizing the website and first-party data, and even better, it helps grow margins and profitability (see figure below).

The Landscape Of Providers Is Vast And Fragmented

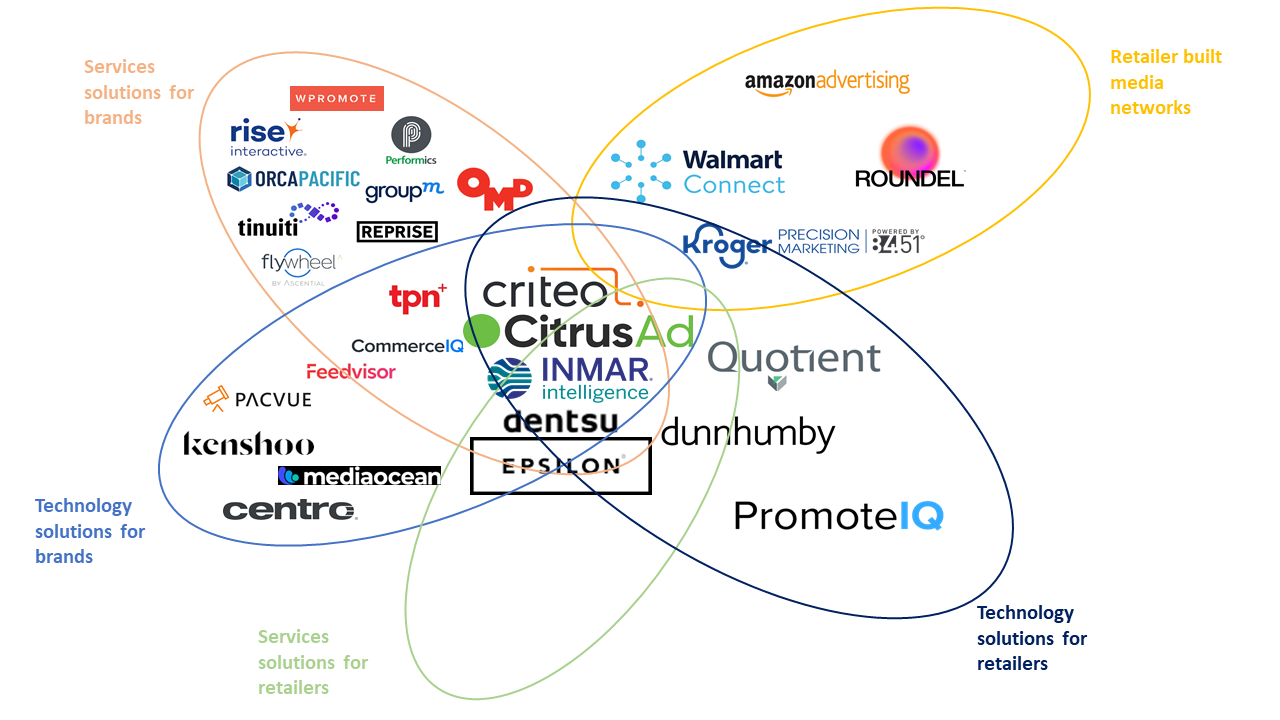

Retailers and brands are not the only ones getting in on the growth. There is a significant new category of third-party providers that help retailers set up their own media network and help brands buy from those retail media networks. It is a fragmented — and overlapping — space that just keeps growing in numbers (see figure below). To help provide clarity on the category of providers in retail media, we published research this week on retail media solutions. We distilled the landscape of providers down into into three categories:

- Solutions that support brands. These are vendors that help brands buy ad inventory from retail media networks in a self-serve or managed-service capacity.

- Solutions that support retailers. These are vendors that stand up a media network for retailers to monetize their e-commerce website, app, and first-party data. The vendors in this bucket span technology and service providers.

- Retailer-built networks. We couldn’t not include retailers that have gone it alone by building or buying their way to a fully managed retail media network. These retailers have spent significant money in supporting their technology efforts, in hiring, and in marketing their network. And they offer brands self-serve tools to skip the middleman and manage their campaigns directly.

Questions? Thoughts? Feel free to schedule an inquiry with me to talk.