Top Five Challenges US Retailers Face Due To Rising Interest Rates

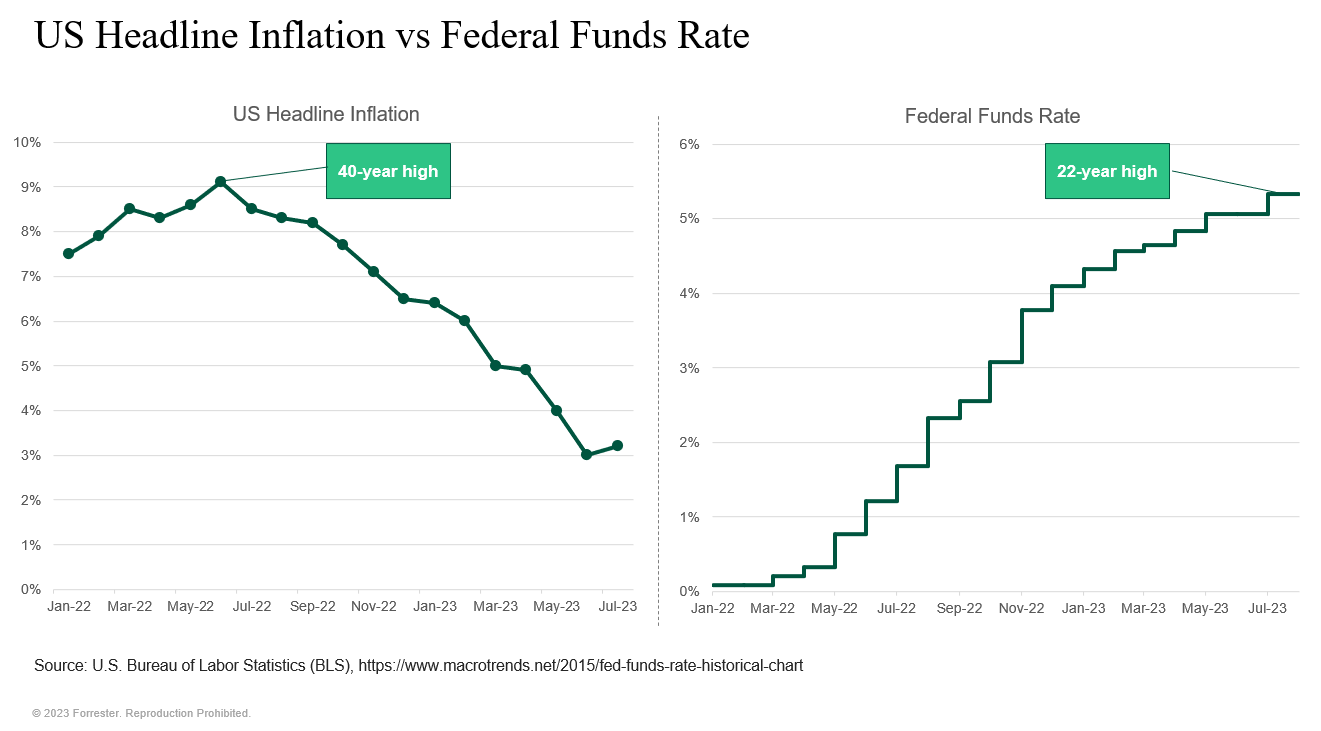

Starting in March 2022, the US Federal Reserve (“the Fed”) initiated a cycle of interest rate hikes to bring down inflation, gradually raising rates from nearly zero to a target range of 5.25% to 5.50% in July 2023 (see figure below). It is likely that the Fed will maintain interest rates at elevated levels throughout 2023. Consequently, US retailers face several challenges in the near term:

- Consumer spending slowdown will impact retailers’ top line. With high interest rates, consumers may allocate more of their income toward higher interest payments in credit cards, mortgages, and auto loans. As a result, their disposable income will decrease. Higher interest rates will discourage consumers from making credit-based purchases of high-ticket items. This will directly affect the top line of retailers in categories such as home improvement, appliances, and automotive. Retailers may experience lower foot traffic, fewer transactions, and decreased sale volumes, particularly for non-essential items.

- Higher borrowing costs will hinder retailers’ business investments. Retailers may delay or scale back plans for store expansions, renovations, or technological upgrades because higher borrowing costs will limit their ability to invest in growth initiatives. With margins in the retail sector often tight, higher interest payments on existing loans and more expensive rates for new borrowing will reduce retailers’ financial flexibility. Retailers may experience reduced cash flow that could lead to difficulties in timely payments to suppliers and employees.

- An economic slowdown will feed declining consumer confidence. A slowing economy can make individuals more cautious about their spending, including for retail products. If consumers curtail spending, retailers will experience reduced revenue, leading to potential job cuts and a weaker job market. This, in turn, feeds back into lower consumer confidence as individuals worry about their employment prospects and overall financial stability.

- Increased carrying costs and slow-moving inventory complicate inventory management. With higher interest rates, the financing and carrying costs of inventory will also escalate. Retailers may face challenges in securing short-term loans or credit lines to cover operational costs and maintaining optimal inventory levels to prevent overstocking or understocking. Retailers may experience slower inventory turnover rates, particularly for high-ticket items. This can result in a buildup of slow-moving or obsolete inventory, tying up valuable resources and reducing available cash flow.

- Discounting and promotions will put retailers’ profit margins under pressure. Retailers may face increased competition for a smaller share of the cost-conscious consumer’s wallet. This intensified competition will lead to pricing pressure, with retailers resorting to discounts and promotions to attract customers. Price reductions may entice buyers, but they will also erode profit margins. As one retailer offers discounts and promotions to attract customers, others may feel compelled to follow suit. This can lead to a price war, further eroding profit margins across the industry.

Our newly published US Online Retail Forecast, 2023 To 2028 provides insights about US total retail sales, online retail sales, and online retail penetration for 30 product categories for the next five years, with historical data going back to 1998.

Want to talk to us about our research? Please schedule an inquiry or guidance session with me!