A Recap Of 115 Retail Website Promotions On Black Friday And Cyber Monday 2023

This week closed out the busiest shopping weekend of the year, spanning Black Friday to Cyber Monday. Although some consumers have been holiday shopping for months, a record-breaking 200.4 million consumers showed up both online and in stores over the weekend, according to the National Retail Foundation.

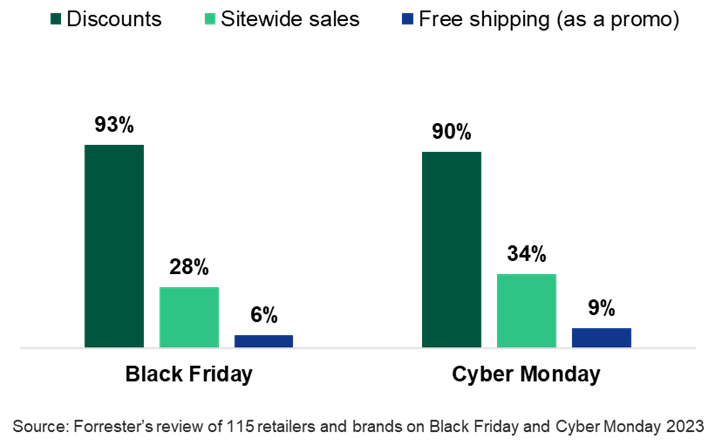

To get a better sense of what retailers did online on Black Friday and Cyber Monday this year, we again reviewed 115 retailer and brand home pages, which span several product categories. Among other highlights, we found that:

- Overall retailer participation was high, but value was mixed. Similar to previous years, nearly all of the 115 retail and brand sites we reviewed had some form of promotion (see figure below). While sales were plentiful, sitewide discounts were hard to come by: Just 28% of retailers had a sitewide sale on Black Friday, rising slightly to 34% on Cyber Monday. Free shipping was even rarer, with fewer than 10% offering free shipping as a promotion (note that this number excludes those that offer free shipping year-round). Instead, many offered sales on select product categories or ran additional promotions on their already-discounted sale sections.

- Some retailer offers had caveats to encourage spending. Rather than offer a flat discount across products, some retailers and brands followed a tiered approach where customers get larger discounts as their spending increases. Glossier’s 25%-off sitewide sale increased to 30% off for purchases of $100 or more, and Ann Taylor added a combinable 15%-off discount to purchases over $200 (the site was already 50%-off sitewide). Some retailers only offered a sitewide discount if customers met a certain spend minimum. Mejuri’s site was 25% off for purchases over $150, Instant Pot was 50% off for purchases over $149, and Olay was 25% off for any purchases over $30. Saks Fifth Avenue’s Cyber Monday was $50 off for every $200 spent, and Neiman Marcus took the tiered approach (e.g., $50 off $250 in spending or $500 off $2,000 in spending).

- Savvy retailers outlined shipping deadlines to manage customer expectations. In December 2022, one-third of US online adults experienced estimated (promised) shipping time frames that were longer than expected (i.e., deliveries were late). To combat this issue, Sephora includes deadlines for its various fulfillment methods (e.g., order by December 19 for free shipping and order by December 24 at 4 p.m. for curbside and in-store pickup). Other retailers — among them Ann Taylor, J.Crew, Michael Kors, Rothy’s, and UGG — included detailed shipping deadlines throughout their sites.

- Free shipping is still not the industry norm. Three-quarters of US online adults say that free shipping is influential in determining which retailer they’ll purchase a product from online, per Forrester’s Retail Benchmark Recontact Survey, 2023. Still, many retailers required customers to reach a minimum order threshold to unlock holiday shipping perks. Bloomingdale’s was an exception: The department store offers free shipping year-round to its loyalty members, but during the holidays (October 31–December 20), all shoppers have access to the perk. Electronics brands Canon and HP also stood out with free shipping from November through December (and through mid-January for HP!).

Stay tuned for more posts from our holiday-prep blog series. And if you have any holiday-related questions and are a Forrester client, please get in touch via an inquiry or guidance session. Wishing you a very successful rest of the end-of-year holiday season!