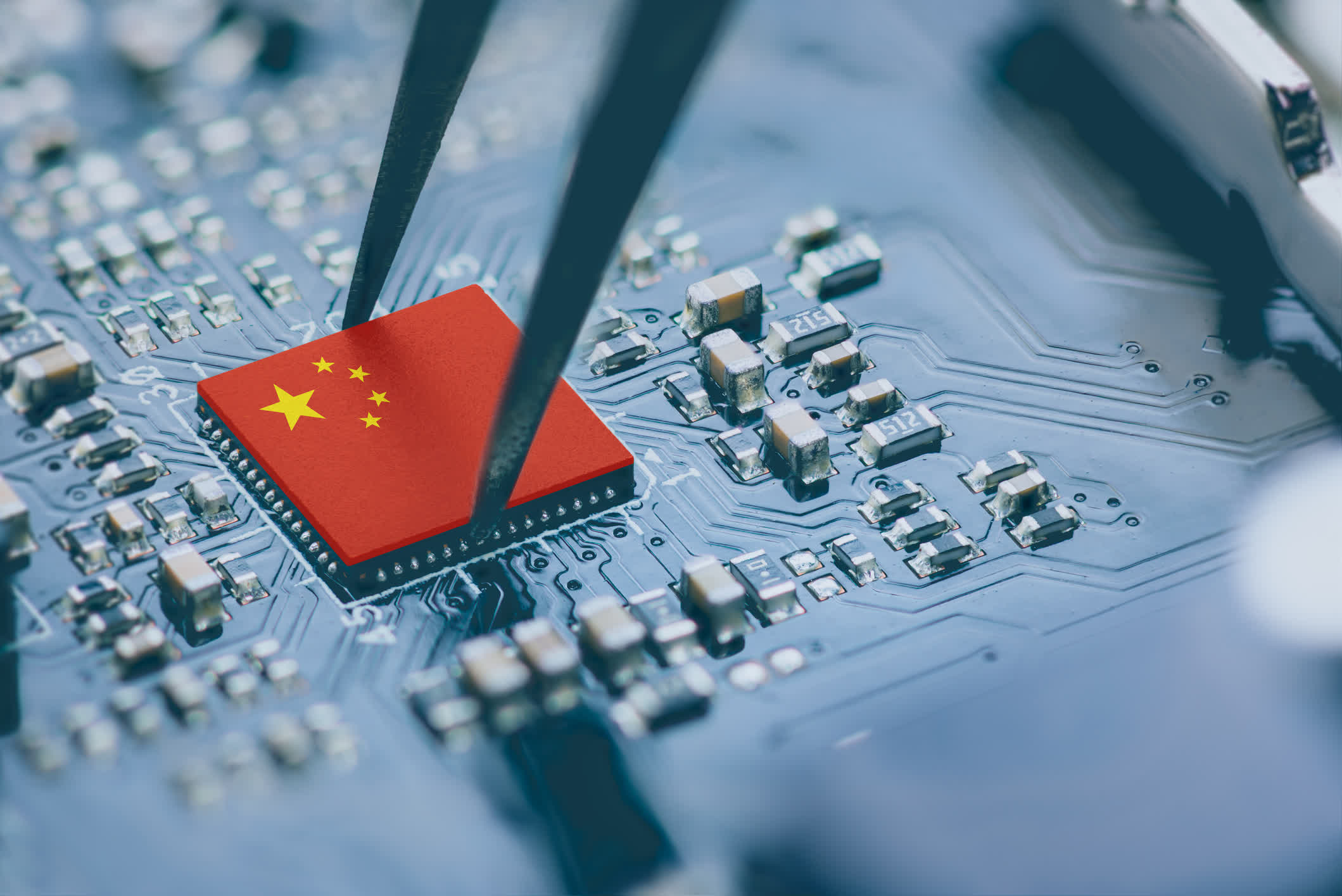

What just happened? China has introduced new guidelines that will phase out US processors and software from its government computers and servers. The rules mean that CPUs from Intel and AMD, along with Microsoft Windows and foreign-made database software, will be replaced with homegrown alternatives.

The guidelines, unveiled on December 26, are now being enforced, writes the Financial Times. They order government agencies above the township level to include criteria requiring "safe and reliable" processors and operating systems when making purchases.

The China Information Technology Security Evaluation Center published a list of these safe and reliable products. The CPUs all come from Chinese companies, including Huawei and Phytium, and cover a mixture of x86, Arm, and homegrown architectures.

China has spent years trying to move away from its reliance on overseas technologies in favor of domestic products. Its Made in China 2025 policy goals include dropping its image as the world's factory and becoming a global technology powerhouse in its own right.

China was Intel's largest market last year, accounting for 27% of Team Blue's $54 billion in sales. The Asian nation also generated $23 billion for AMD, representing 15% of its sales. The restrictions will have less of an impact on Microsoft, which counts on China for about 1.5% of its revenues.

The move to prohibit US CPUs in government agencies comes amid increasing tensions between Beijing and Washington. The American government has been restricting China's ability to produce its own advanced chips for years. More recently, advanced AI products from Nvidia have been banned from export to China, leading to the company creating less powerful, China-specific alternatives.

In some ways, the US is mirroring China by lessening its reliance on the country and Taiwan for its semiconductors through the CHIPS Act, which provides $52 billion in subsidies for companies to move manufacturing back to the US. Intel was recently awarded the CHIPS Act's largest sum to date: $8.5 billion in funding, along with $11 billion in loans and a 25% investment tax credit on up to $100 billion of capital investments.

It's not just foreign CPUs and software China wants out of its government buildings. In September, Apple's shares fell 9% following news that China was expanding its ban on the use of iPhones in certain government offices.