Facepalm: Citibank is learning a costly lesson in software design as a triple-checked mistake caused the bank to send out almost a billion dollars in loan payments instead of only $7.8 million. Citibank blamed the blunder on an Oracle banking program with a confusing user interface.

On Wednesday, a judge ruled that creditors do not have to return payments that Citibank made to them in error. The bank was attempting to make $7.8 million in interest payments on behalf of Revlon last August, but a subcontractor in India handling the transaction mistakenly issued $900 million instead. The ruling described the overly confusing process required when using the software in question called "Flexcube"---part of the Oracle Banking Suite.

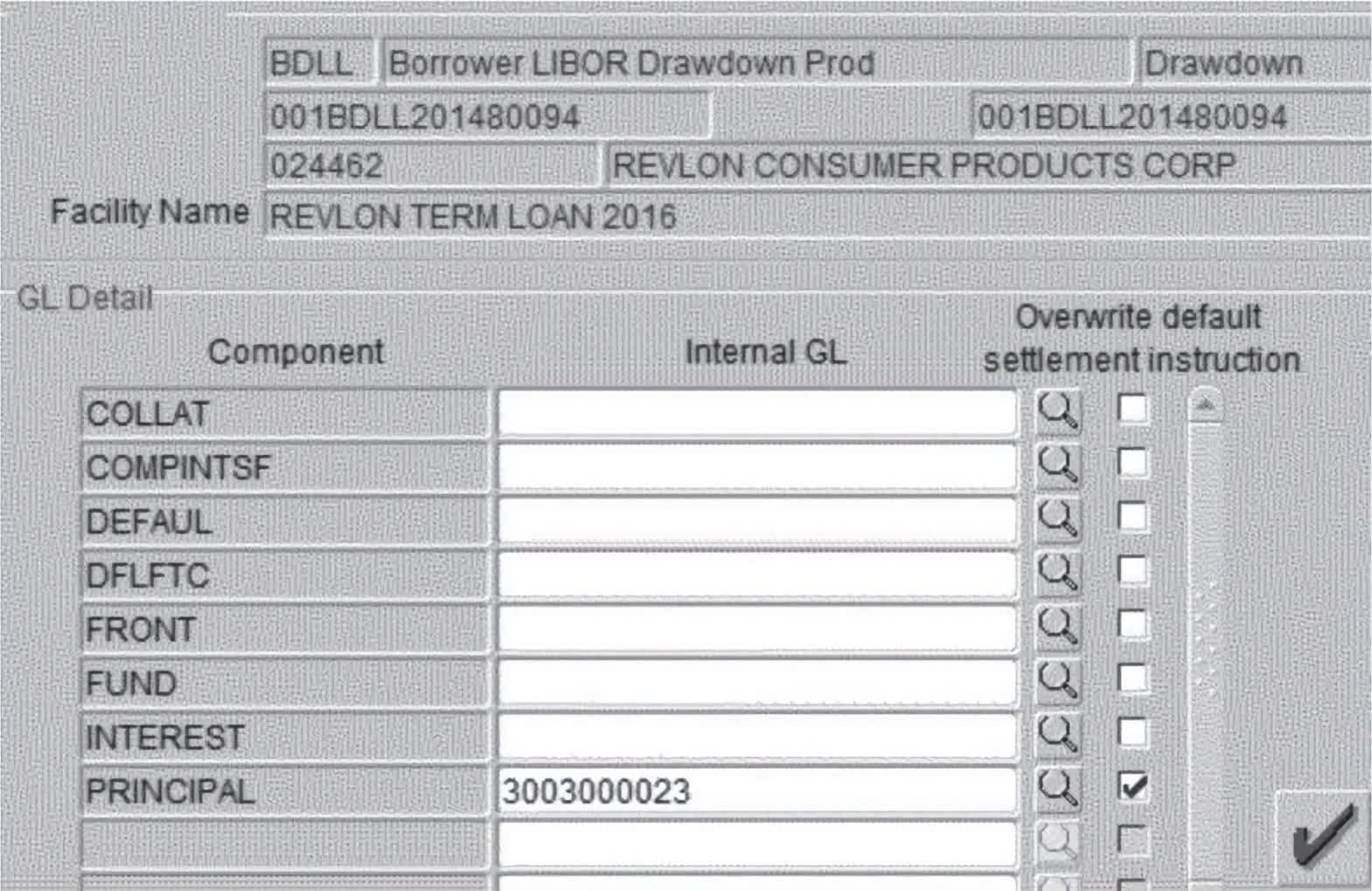

"On Flexcube, the easiest (or perhaps only) way to execute the transaction---to pay the Angelo Gordon Lenders their share of the principal and interim interest owed as of August 11, 2020, and then to reconstitute the 2016 Term Loan with the remaining Lenders---was to enter it in the system as if paying off the loan in its entirety, thereby triggering accrued interest payments to all Lenders, but to direct the principal portion of the payment to a 'wash account'---'an internal Citibank account... to help ensure that money does not leave the bank.'"

The subcontractor did not fill out the user interface correctly, and the entire amount went out to lenders rather than the majority being deposited to the wash account. Citibank requires that three people sign off on large transactions like this. Two workers at the outsourced firm okayed the transfer, and the final signature came from a Citibank senior official in Delaware, writing, "Looks good, please proceed. Principal is going to wash."

Citibank approached creditors and was able to get around $400 million of the funds back from some of the lenders, but others said, "no way." Bloomberg reports that Revlon debt is trading at only about 42 cents on the dollar, and some of its creditors were not willing to re-assume the risk of returning the early payoff.

Citibank filed suit to force them to pay back the funds, but District Court Judge Jesse Furman denied the bank's plea. Generally, in cases like this, the law would be on Citibank's side since it made the payments in error. However, there is an exception in New York called "discharge-for-value."

This defense says that if the receiver of a wire transfer is entitled to the money sent and did not know that the funds were sent by mistake, it does not have to refund the transaction. Revlon's lenders contend that they did not realize the transfers were overpayments. They claim they were under the impression that they were "prepayments" on the loans since the amounts were equal to the outstanding balances "to the penny." The District Court agreed.

"To believe that Citibank, one of the most sophisticated financial institutions in the world, had made a mistake that had never happened before, to the tune of nearly $1 billion --- would have been borderline irrational," Judge Furman wrote in his opinion. "Accordingly, and for the reasons discussed above, the Court holds that the August 11th wire transfers at issue were 'final and complete transaction[s], not subject to revocation.'"

Citibank plans to appeal the decision saying, "We believe we are entitled to the funds and will continue to pursue a complete recovery of them." In the meantime, the judge ordered the lenders to keep the funds in escrow until the appeal process plays out.

Image credit: TungCheung