Why it matters: Battery technology is one of those areas that is getting a lot of promising research results but very little in the form of commercial products we can use to power digital devices, electric vehicles, or off-grid homes. That may soon change thanks to sodium-ion batteries that are safer, more durable, and cheaper to manufacture when compared to conventional lithium-ion batteries.

It's no secret that lithium-ion batteries are at the forefront of modern energy storage and a key driver for electrification efforts worldwide. However, manufacturing them at the scale needed to meet growing demand seems like an almost impossible task. Lithium producers in recent years have warned the world could soon face a shortage of lithium, possibly as soon as 2025.

A big contributing factor is that lithium has gone from being a niche metal used in the ceramics and pharmaceutical industries to one of the most in-demand metals in the span of a few decades. Albemarle – one of the largest lithium mining companies in the world and the one leading the US lithium renaissance – plans to boost its production capacity to 500,000 tonnes annually by 2030 but says that still won't be enough to satisfy the projected demand.

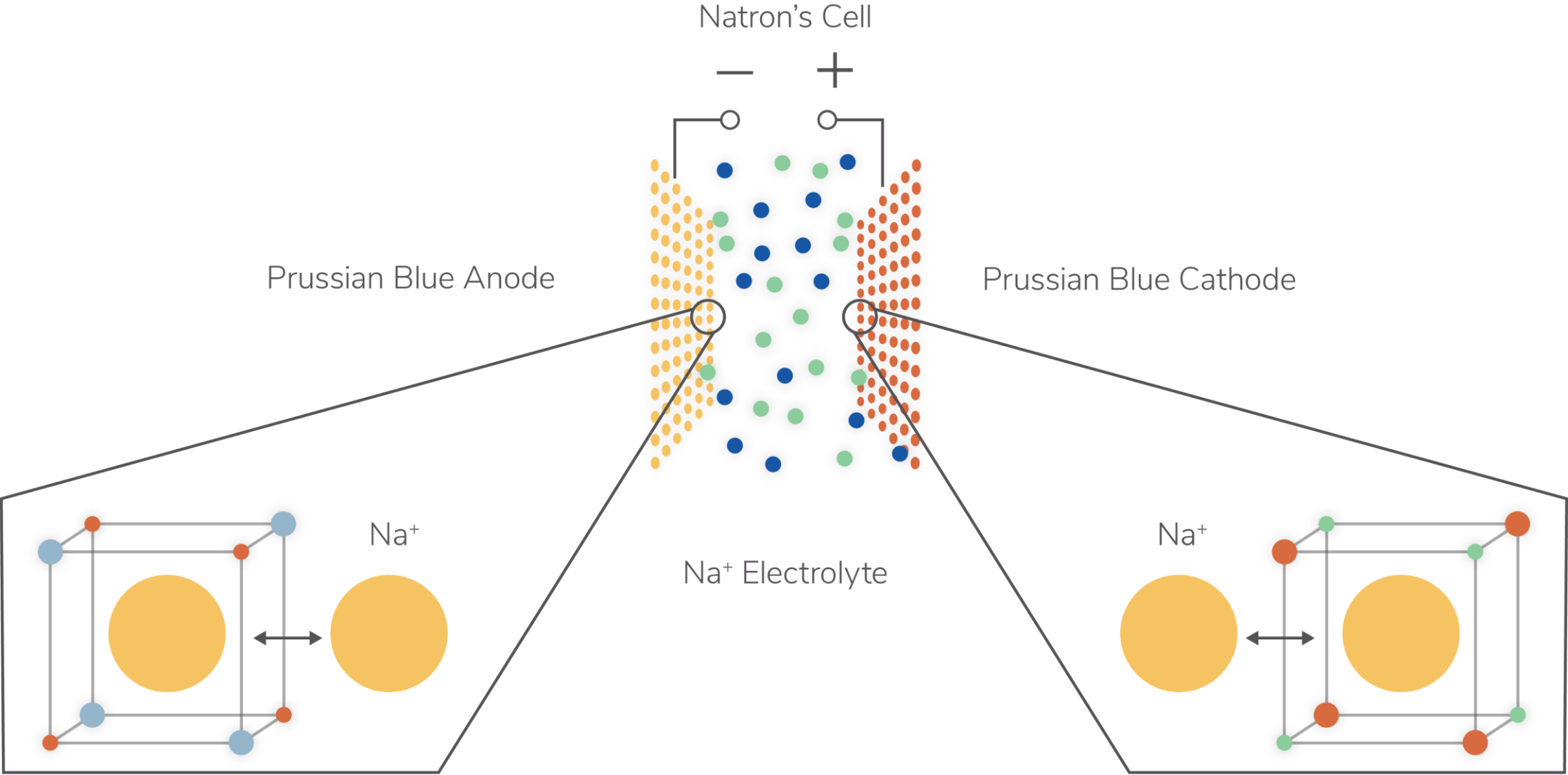

This is where the sodium-ion battery comes in. While it hasn't enjoyed the same spotlight as lithium-ion, it's shaping up to be one of the big technological breakthroughs that can make the electrification dream a reality. Sodium-ion batteries have a similar design to lithium-ion batteries and can be manufactured using the same or similar industrial processes. In this type of battery, sodium ions replace the lithium ions in the cathode and the lithium salts in the electrolyte (the liquid that helps ferry charge between the battery electrodes) are swapped for sodium salts.

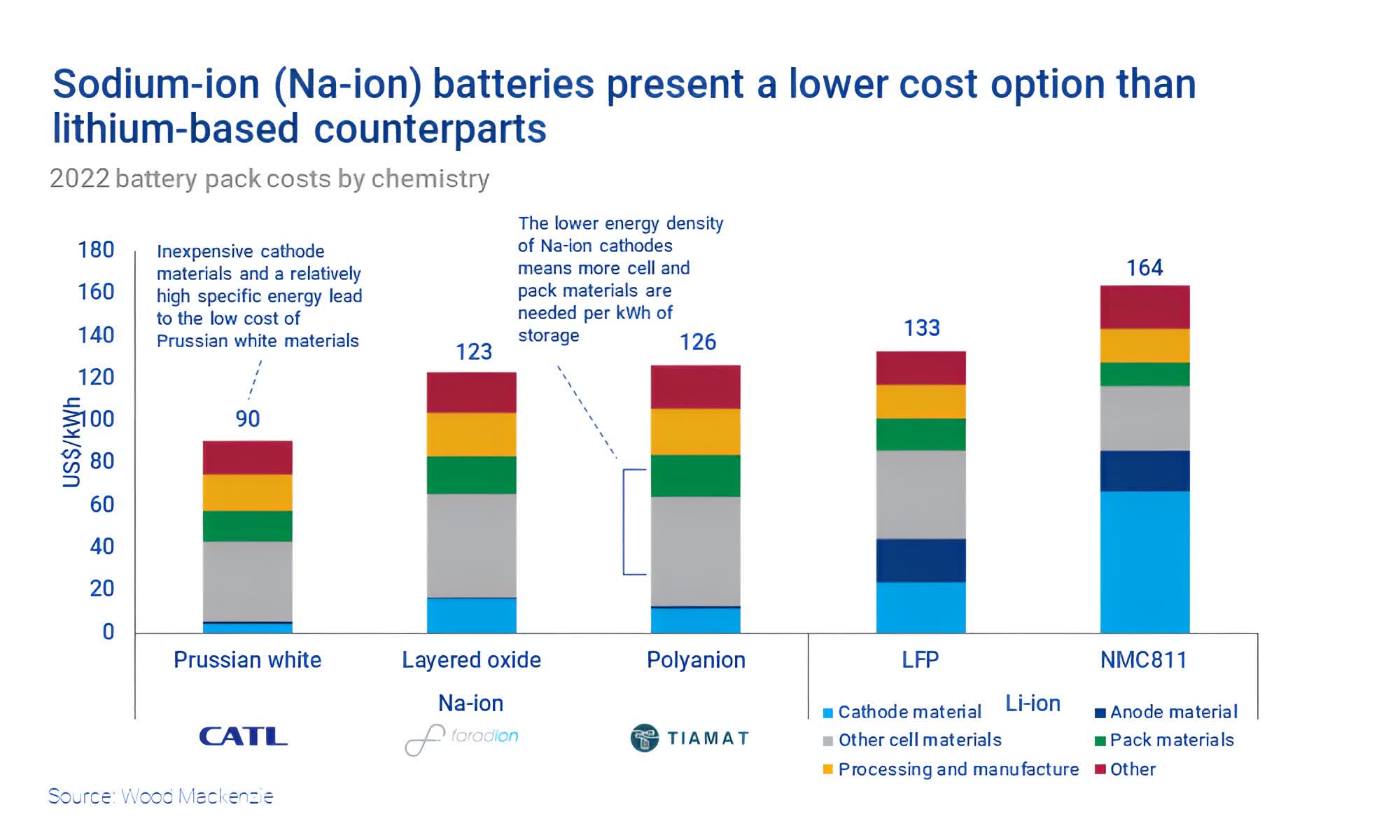

Sodium-ion batteries aren't a new concept, but the idea to manufacture them at scale has only gained traction in recent years. Sodium is significantly more abundant than lithium, so it's cheaper and easier to source while also being less vulnerable to geopolitical tensions. As of writing, the price of sodium carbonate tops out at $286 per metric ton, while battery-grade lithium carbonate costs a whopping $20,494 per metric ton.

Chemists have also found that cells with layered-oxide cathodes built using sodium don't require expensive metals like cobalt or nickel to achieve a comparable energy density to that of lithium iron phosphate (LFP) cells, which are widely used in more affordable electric vehicles.

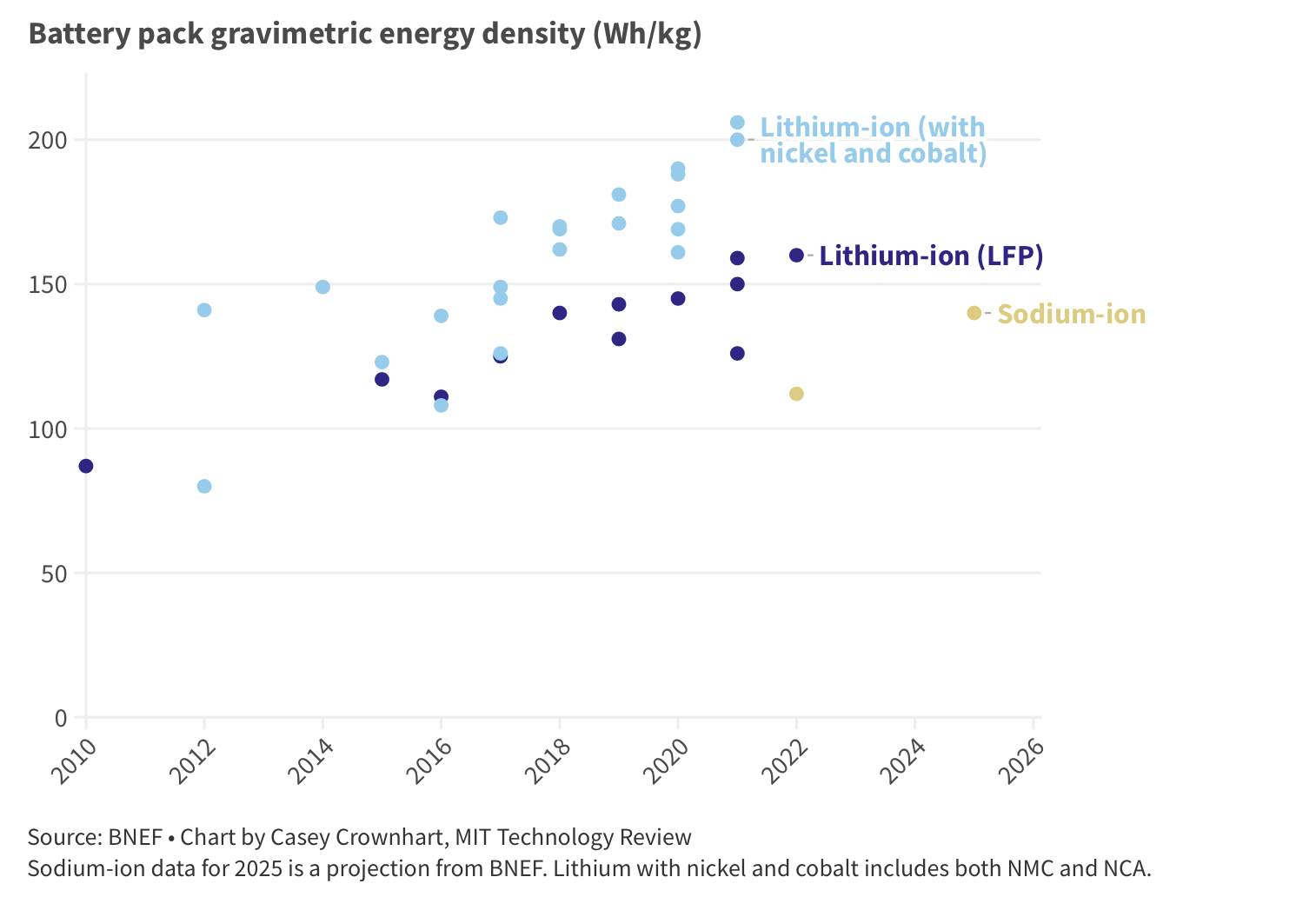

Earlier this month, a team of Japanese researchers at the Tokyo University of Science revealed they've developed a high-capacity cathode for sodium-ion batteries using nanostructured hard carbon. The resulting cells can reach energy densities of up to 312 Wh per kg – about double that of lithium iron phosphate batteries. To put things in perspective, this is also 1.6 times the energy density achieved by the most advanced sodium-ion batteries a little over a decade ago.

Another benefit of sodium-ion batteries is their ability to withstand a wider range of operating temperatures – from -30°C to 60°C (-22°F to 140°F) or even 80°C depending on the chemistry used. This is why companies like Faradion have already started trialing sodium-ion battery installations for stationary energy storage in Australia.

Earlier this year, a joint venture between Volkswagen and JAC Group unveiled the first electric sedan powered by a sodium-ion battery. The vehicle is powered by a 25 KWh battery that offers a relatively modest range of up to 250 km (155 miles), but the two companies are touting fast charging speeds, better low-temperature performance, as well as a longer cycle life for the battery along with a slower decrease in capacity as it ages.

James Quinn, who is the CEO of Faradion, says the safety advantage of sodium-ion batteries cannot be overstated. While lithium-ion cells need to be charged above 30 percent before transportation, sodium-ion cells can be safely discharged to 0V just like a capacitor, which eliminates the possibility of a thermal runaway due to short-circuits. And as you can see in the video above, puncturing a sodium-ion cell at full charge also doesn't turn it into an incendiary grenade.

While Faradion is mostly interested in stationary energy storage for now, other companies like Natron Energy are already delving into the car industry. The Santa Clara-based startup is using a commonly produced material called Prussian blue to make electrodes for its sodium-ion batteries, which are rated for anywhere between 50,000 to 100,000 charge/discharge cycles. They can also be fully recharged in 15 minutes or less.

Natron recently entered a partnership with Clarios International to mass produce its sodium-ion batteries at the latter company's Meadowbrook facility in Michigan using the same equipment that is currently used to make lithium-ion cells. As production ramps up in the coming months, Natron says this will become the world's largest sodium-ion battery factory in the world.

How things will play out for sodium-ion batteries remains to be seen, but unlike many solutions that have yet to see the outside of a lab, they sure look promising. It all depends on how prices will fluctuate for materials as the technology matures and more factories start producing sodium-ion cells at scale.

Global production capacity is expected to reach 186 GWh annually by 2030, compared to 6.5 TWh for lithium-ion cells. This means that sodium batteries probably won't overthrow the dominance of lithium-ion anytime soon. However, they seem like an increasingly attractive alternative for a variety of applications and there is potential for them to become the go-to solution in the long term.