.png?sfvrsn=2ba93ce9_2)

By my count I’ve been covering the IT channel in some form or another since 2003. Yes, 20 years. And while I lament the reflection on my own age, I love what two busy decades (and many more years before that) say about the channel’s longevity. It’s been quite a ride.

In that time, I’ve witnessed much. It’s truly been a trip to watch the ranks of MSPs, solution providers, hardware and software resellers and beyond establish a pivotal role in the technology go-to-market chain amid business model changes, industry shifts, technological advances and failures, and macroeconomic ups and downs. Oh, and a pandemic. Resilience is a word that comes to mind.

And while much about today’s channel remains true to its infrastructure-based reselling and services roots, the 2023 version is more nuanced than ever, changing in ways big and small. How they sell, what they sell, to whom they sell—these are constantly shifting plates.

The channel composition itself has expanded greatly as well with new types of adjacent players, influencers, cloud vendors and non-traditional companies entering the fray in droves. Each is contributing to a robust channel that keeps a foot firmly in traditional channel activities and an eye on emerging go-to-market trends, customer needs and technological advances.

As an organization, CompTIA has supported and fostered the IT channel since its inception. CompTIA membership remains largely comprised of channel companies of all stripes, as well as the many vendor and distributor firms that make up the vast industry responsible for developing, delivering and managing tech solutions and services for customers and the IT workforce.

I’m proud to say that this month marks the rollout of the 10th version of CompTIA’s annual State of the Channel research study. We’ve been collecting and analyzing data over the years to keep tabs on the channel’s health, trajectory, trends and more. The 2023 version reveals a bountiful dose of optimism about the present and future of the channel, combined with a realistic understanding of the challenges ahead.

This iteration of the study also sports international flair, featuring data collected from channel firms in the United Kingdom and Ireland, Benelux (Belgium, Netherlands, Luxembourg), DACH (Germany, Austria, Switzerland), ASEAN (Association of Southeast Asian Nations) and ANZ (Australia-New Zealand).

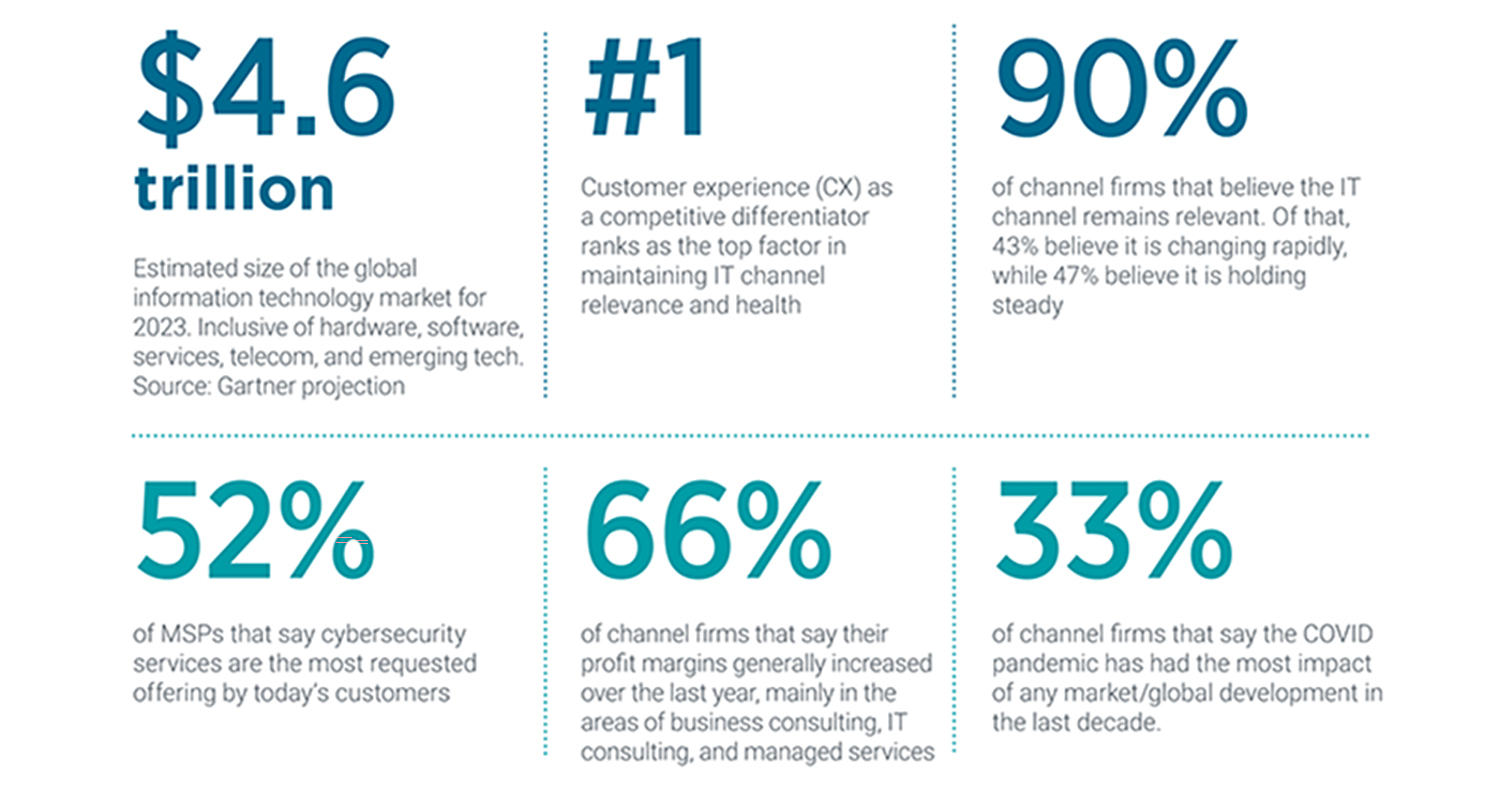

Some key takeaways to pique your interest:

- It’s a big tent channel: The ecosystem is real and growing. Channel composition today is steadied by a traditional base of companies that is also welcoming a whole host of new participant types.

- Customer experience rules: A services-based channel that knows how to provide superior customer experience to an empowered tech buyer is the number one driver for continued channel health.

- Profits are up for most: Clearly good news, particularly among services-based channel firms. Caveat, however, this trend has at least some grounding in the cost-cutting/efficiency efforts that ensued during the pandemic.

- MSPs faring well: The recurring revenue business model is paying off for many of the channel firms that have embraced it to-date, buoyed in part by the remote work surge of the last three years. But MSPs are still paddling hard to gain ground in cybersecurity.

- Vendor choices are mushrooming: The rapid influx of cloud and other new vendors to the industry has changed the vendor-partner relationship dynamic in many ways. And most channel firms are happier for it. Partners in this year’s study that said they were “very satisfied” with their vendor relationships nearly doubled between 2021 and 2023.

- Competition isn’t what it used to be, but that’s OK: Partners today have more rivals to deal with in the quest to win customers. Nearly half of respondents in the study cited online marketplaces and vendors’ direct sales as their main competition today—as opposed to other channel firms. The good news is that savvy firms have figured out how to work with online marketplaces, selling their own offerings through them or helping customers navigate the dizzying array of choices.

State of the Channel Statistics

I’ve had a fortunate front-row seat to the channel’s last two decades. One observation in the “change is inevitable” line of thinking is this: For the channel, change looks more like an expansion and evolution of the greater ecosystem and its players vs. a forced march for everyone to transform their individual business. Some companies will remain in the business model they started in—and continue to thrive to their own expectations. Others will race toward the next new thing, focusing on innovation. Still others will live in the middle, reaping rewards that can come from a hybrid mix of the old and the new.

For all the details in this year’s report, including data on channel mergers and acquisitions, participation in peer groups and specific trends in managed services, take a look at the CompTIA State of the Channel 2023.

Carolyn April is senior director of industry analysis at CompTIA.

2023 State of the Channel

CompTIA registered users and company members have access now to the full report!

Add CompTIA to your favorite RSS reader

Add CompTIA to your favorite RSS reader

.png?sfvrsn=2c1982b1_2)