The Future of Banking: By 2030, Banking Will Be Invisible, Connected, Insights-Driven, And Purposeful

Forrester IT

SEPTEMBER 30, 2024

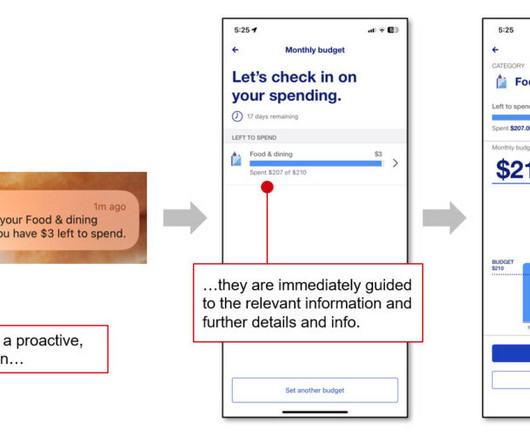

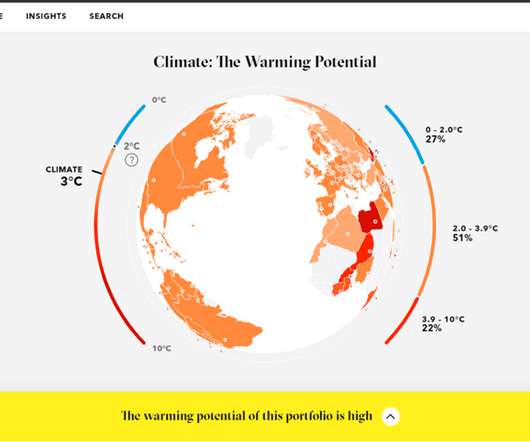

In the rapidly evolving financial landscape, banks are facing challenges that require them to adapt and innovate. Trust is the foundation upon which successful banking relationships are built, and it will continue to be a crucial factor in shaping the future of the industry. […]

Let's personalize your content