Make Cyber Insurance Work For You

Forrester IT

SEPTEMBER 11, 2023

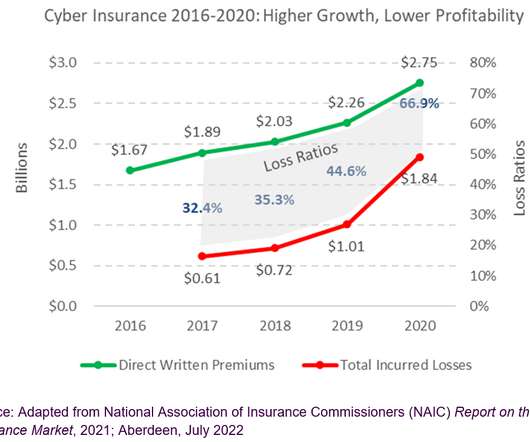

Three factors are certain to influence your cyber security program today: regulations, third-party partners, and cyber insurance. Increasingly stringent requirements, exclusions, and policy premium costs may appear as a trifecta of pain launched your way from insurers. But cyber insurance is really an opportunity.

Let's personalize your content