Bank downplays ties to FTX sister company in latest fallout from crypto exchange failure

GeekWire

NOVEMBER 29, 2022

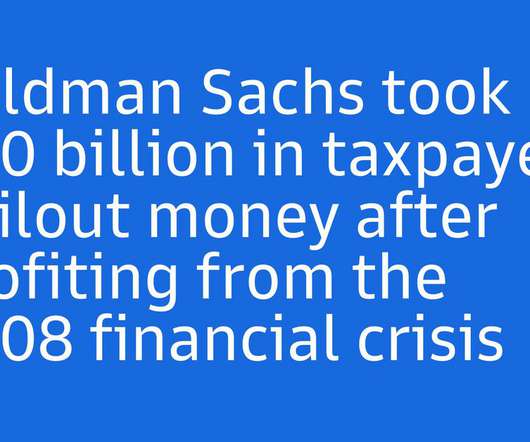

A bank in rural Washington state sought to distance itself from FTX on Tuesday following a report last week detailing its connections to the failed cryptocurrency exchange. 23 that FBH, the parent company of Farmington State Bank, received $11.5 Moonstone Bank’s reputation as well.” (Bigstock Image).

Let's personalize your content