Success Of New-School Vendors Shows That Lean Core Banking Is Finally Here

Forrester IT

MAY 23, 2022

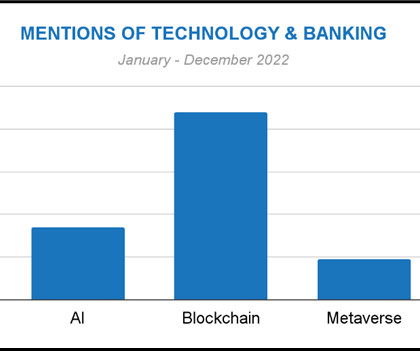

Modern banking platforms allow banks to elevate their customer experience and deliver more business value more seamlessly and more effectively. Banks and their technology teams can leverage market dynamics to make digital transformation more feasible both architecturally and economically.

Let's personalize your content