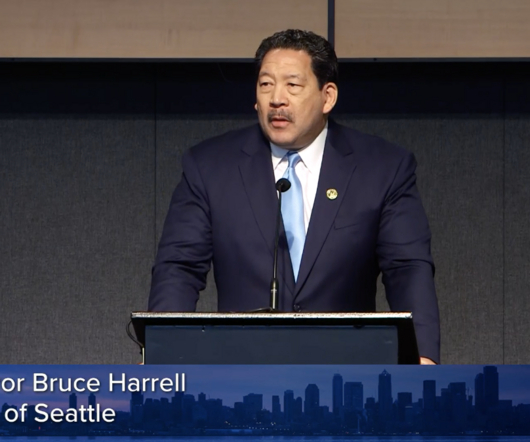

Seattle approves new city budget that plugs shortfalls with surplus revenue from business tax

GeekWire

NOVEMBER 29, 2022

Now the city is using the surplus to help close major gaps in its budget. The JumpStart funds aren’t earmarked for particular programs but the General Fund pays for a variety of city services. . On top of that, the city released estimates in November that predict a net decreases of $64 million in the Real Estate Excise Tax, $9.4

Let's personalize your content