Building A Private Bank For The Next Generation

Forrester IT

APRIL 22, 2021

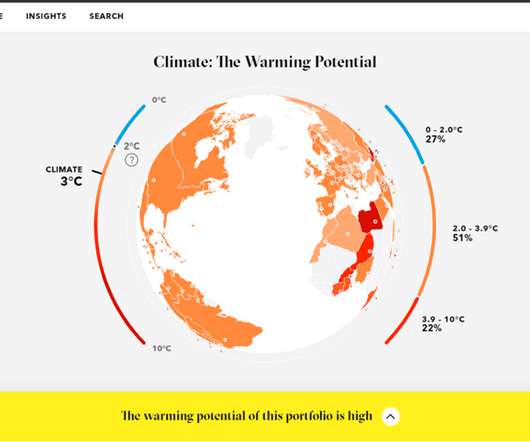

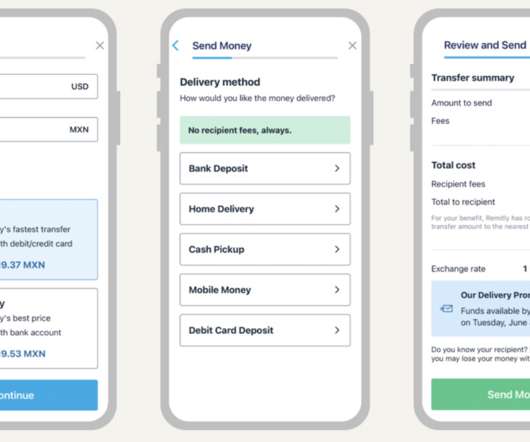

Significant gaps continue to exist in private banking, forcing firms to rethink pricing and organizational models. As a result, high-net-worth clients are not fully benefiting from some of the digital innovations that are changing how customers interact with their private banks.

Let's personalize your content