Madrona backs WaFd Bank spinout developing consumer software for regional banks

GeekWire

FEBRUARY 28, 2023

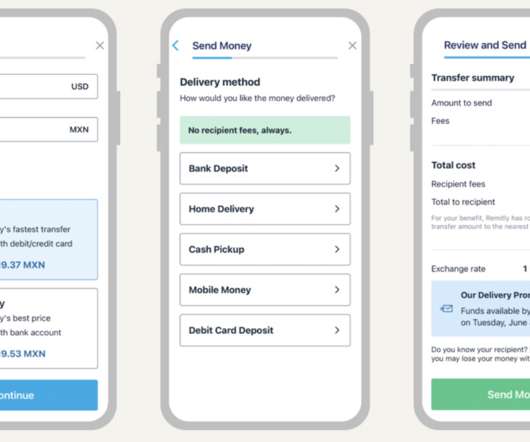

(Archway Photo) Key Takeaways Archway , spun out of Washington Federal (WaFd), provides digital banking infrastructure to regional banks. The Seattle-area startup raised $15 million in a round co-led by WaFd Bank and Madrona Venture Group. The goal is to help community banks stay competitive with giants like J.P

Let's personalize your content